Is San Diego’s Housing Market About to Correct? Inventory is Skyrocketing in Early 2025

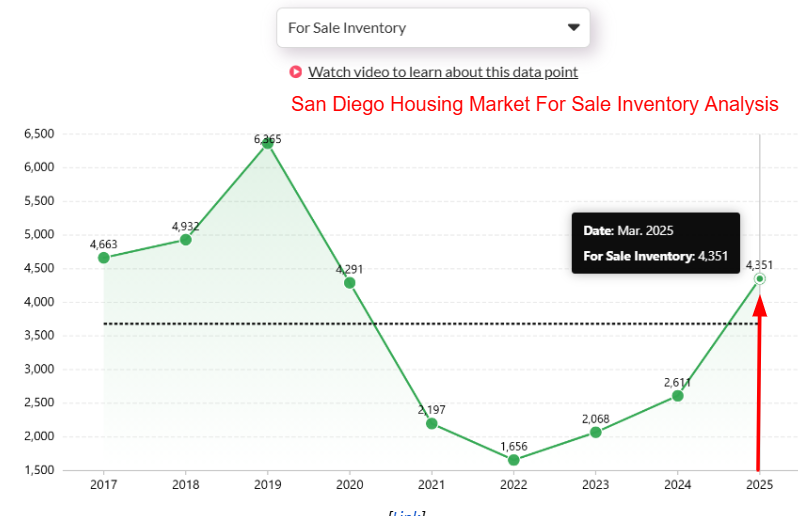

San Diego’s housing market is nearing a turning point as for-sale inventory surges in early 2025. According to data available on Reventure App, homes for sale have jumped to 4,351 in March 2025, more than doubling from the 2022 low of 1,656. This sharp increase marks the highest inventory level since 2020, indicating a potential market correction ahead as supply outpaces demand and buyers regain negotiating power.

San Diego Active Listings Climb While Home Values Continue to Rise in 2025

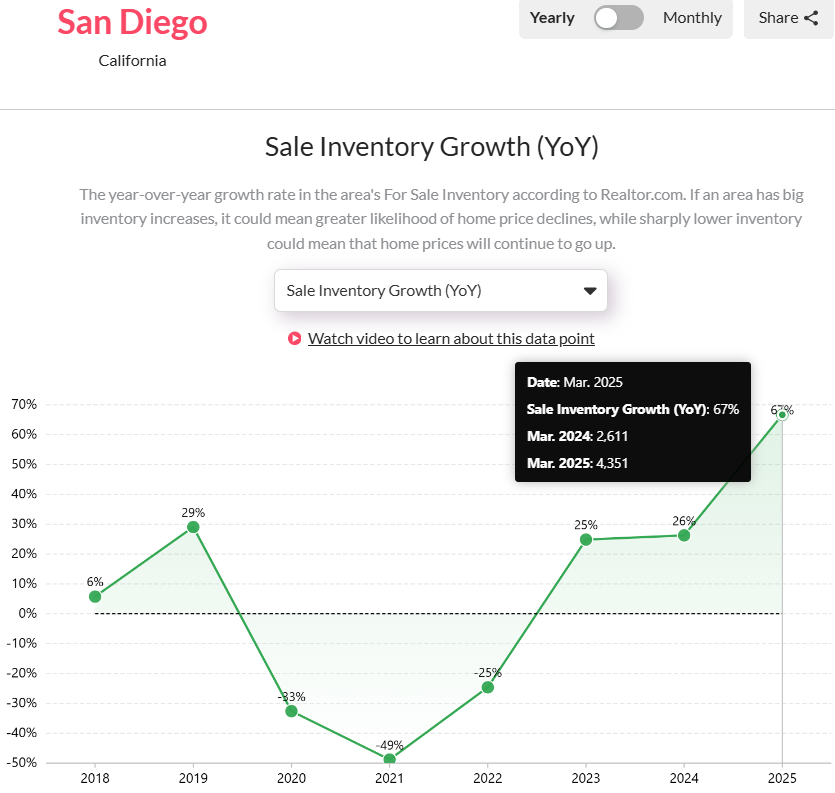

Homes for sale in San Diego, CA have surged in early 2025, with 4,351 homes on the market. This marks a dramatic 67% increase from the 2,611 listings recorded in March 2024 and a significant rise from the pandemic low of just 1,656 listings in 2022. The sharp rise in inventory reflects a market that is gradually shifting from tight supply to a more balanced, though gradually softening, market environment. However, the influx of new listings hasn’t yet translated into falling prices.

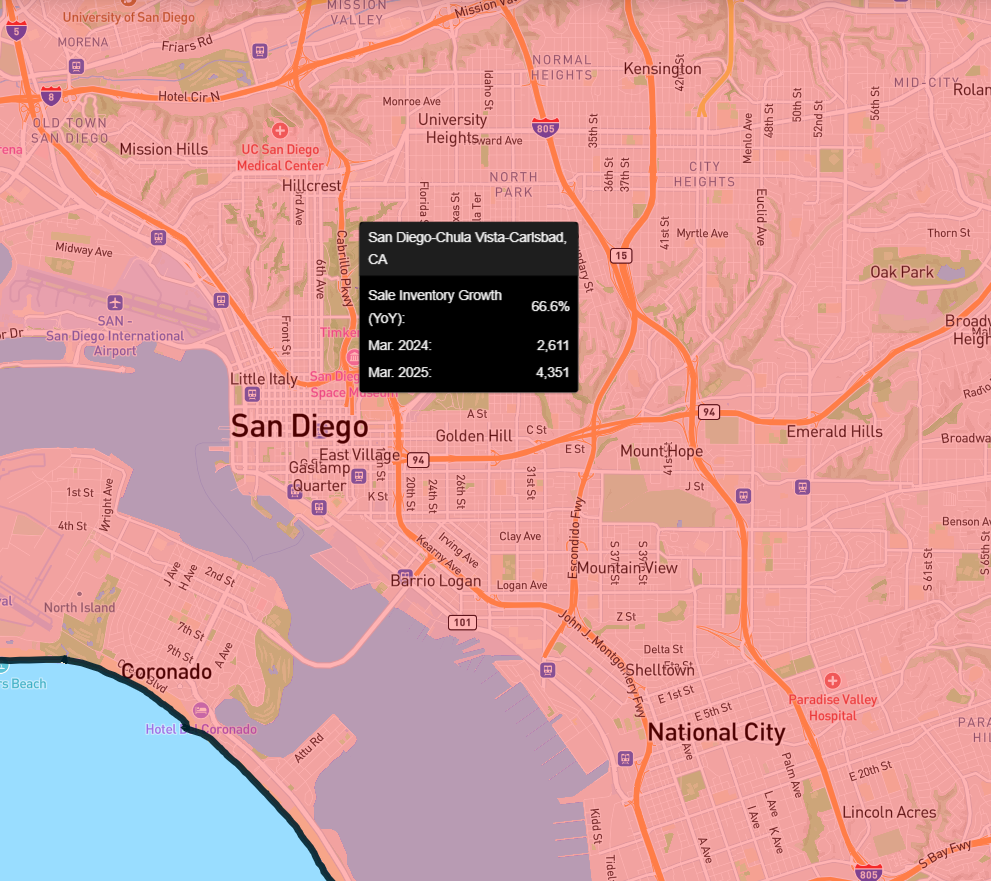

San Diego’s homes for sale increased by 66.6% in 2025. Access the above sales inventory growth YoY map of the metro here. [Link]

Home values in San Diego continue to climb, reaching a typical value of $948,400 in 2025. That’s up from $916,300 a year earlier, reflecting a modest but steady year-over-year growth of approximately 3.5%. Moreover, despite the rising inventory, high home prices remain a barrier for many potential buyers, particularly first-time purchasers. As affordability worsens, buyer demand is showing signs of fatigue, which could cool price appreciation in the months ahead, even as listings continue to rise.

San Diego Tops U.S. Metros in Inventory Growth, Raising Odds of Price Decline in 2025

San Diego experienced the highest year-over-year growth in active listings among major U.S. metros, with inventory rising 67% in March 2025 from 2,611 in 2024 to 4,351 homes for sale. This spike surpasses growth in Los Angeles (52%), Atlanta (44%), Phoenix (39%), Miami (40%), and Boston (18%). New York saw a modest 3% increase. This surge suggests that San Diego’s market could face greater downward pressure on prices compared to other cities.

San Diego’s sales inventory growth YoY has topped the major US metros in 2025. Access the above sales inventory growth YoY chart of the metro here. [Link]

While inventory growth often points to softening demand, San Diego’s rapid increase is especially significant when contrasted with cities like New York and Boston, which are seeing far more gradual changes. Moreover, many of these metros have already undergone large inventory corrections in prior years. If the trend continues, it’s possible that San Diego’s price growth could not only flatten but even turn negative by late 2025. However, overall economic conditions and buyer sentiment will ultimately shape that trajectory.

San Diego Home Price Forecast Trends in 2025

San Diego’s housing market remains technically balanced, but recent data suggests it is beginning to soften. The Reventure Home Price Forecast Score for 2025 sits at 46 out of 100, placing the metro just above the threshold of a declining market. This score falls within the 45–49 range, which indicates stability with a downward tilt. While the market is not yet in full retreat, the momentum seen in 2021 and 2022 has clearly slowed.

San Diego, CA’s Home price forecast score reached 46/ 100 in 2025. Access the home price forecast score chart of the metro here. [Link]

We can expect year-over-year price growth to remain positive in the near term but begin trending downward by mid-2025. In such a scenario, reduced buyer demand, rising numbers of sellers, longer days on market, and more frequent price cuts are likely outcomes. These are typically early warning signs of future home price declines, which could materialize if current softening trends persist. If you want a detailed analysis of the San Diego, CA metro area, explore the housing market data at the ZIP-code level on Reventure App.

FAQs about San Diego’s Housing Market

1. Is San Diego’s Housing Market Expected To Crash In 2025?

While San Diego is showing signs of softening, with rising inventory and slowing price growth, it is still considered a balanced market. A full market crash is not currently projected, but trends suggest potential downward pressure on prices later in the year.

2. Why Is San Diego’s Home Inventory Increasing In 2025?

San Diego’s inventory has surged by 66.6% year-over-year, likely due to a combination of high home prices, subdued buyer demand, and more sellers entering the market. This increase may shift the balance of power toward buyers, especially if demand continues to weaken.

3. Are San Diego Home Prices Still Rising Despite Higher Inventory?

Yes, home prices in San Diego are still rising, with a typical home value reaching $948,400 in early 2025, up around 3.5% from the previous year. However, the continued rise in inventory could slow or reverse this growth later in the year.

Access Housing Market data for California and other States on Reventure App.