Zillow Just Flipped Their 2026 Housing Market Forecast (Prices Going Up)

For months, Zillow’s outlook for the housing market has been stuck in the red. Their models kept pointing to falling prices and sluggish demand. But something just shifted.

The company still expects home values to end 2025 slightly lower. They’re forecasting a 0.9% drop for the full year. That means by December, prices should be below where they started the year. On the surface, that doesn’t look like good news.

Here’s the twist. For the first time in four months, Zillow is now predicting growth when looking ahead to 2026. From July 2025 to July 2026, home values are expected to rise by 0.4%. It’s not a big jump. But it’s a clear change in direction.

Why now? The main reason is supply. New listings from sellers had been climbing earlier in the year, building up inventory. But recently, fewer owners are putting their homes on the market. That slowdown is easing pressure on prices.

It’s a small pivot. Still, after months of gloomy calls, Zillow just gave buyers and sellers a reason to pay attention. Let’s discuss Reventure’s home price forecast (%) now.

Reventure’s 1-Year U.S. Home Price Forecast

Reventure App’s 1-year home price forecast for the U.S. housing market stands at -1.4%.

However, Reventure believes the national number hides a split. Some states are set to drop faster, while others remain surprisingly firm.

Now, let’s talk about the bifurcation in the 3 highest and lowest forecasted US states on Reventure.

Highest vs. Lowest: State Forecast Split in 2025

The national score is weak. But state stories are very different. Let’s look at the three highest and lowest forecasts.

The Highest Forecasted States

Connecticut, Illinois, and New Jersey lead 2025 with a price forecast above 5%. Access the above table here. [Link]

- Connecticut leads the pack with a 7.1% increase. That’s a big jump in a tough market. Strong demand near New York, limited supply, and steady incomes are key drivers here.

- Illinois comes next with a 6.0% gain. Chicago’s affordability compared to coastal hubs is drawing buyers. Inventory also remains tight, keeping prices supported.

- New Jersey takes third at 5.8%. Proximity to New York City and suburban demand continue to play a role. Families still want space, and listings remain scarce.

These states show how local demand and supply can defy the national picture. In markets with strong regional economies and limited housing stock, prices are holding up.

The Lowest Forecasted States

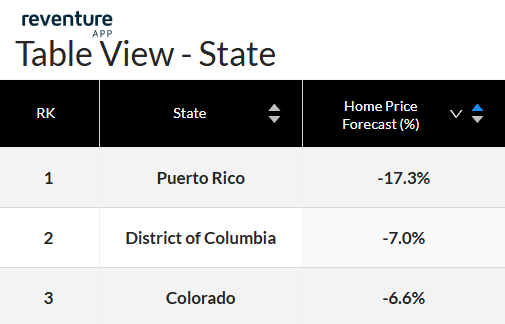

Puerto Rico, D.C., and Colorado face the steepest declines in 2025. Access the above table here. [Link]

- Puerto Rico shows the steepest decline at -17.3%. The local economy is struggling, migration outflows remain high, and housing supply is softer than demand.

- The District of Columbia follows with -7.0%. Rising interest rates and affordability pressures are biting hard here. Luxury listings and condos are especially under strain.

- Colorado rounds out the bottom three at -6.6%. After years of fast growth, the market looks overextended. Supply is catching up, and demand is cooling.

These sharp drops highlight how overheated or fragile markets correct quickly. Unlike the resilient states, these areas face deeper economic headwinds and looser supply conditions.

If you want an area-specific housing forecast, Reventure App provides insights down to the ZIP code for $49/ month. Buyers and renters can spot which neighborhoods are overpriced and which still offer value. Sellers can see where demand is still strong. The market feels cooler, but it is still competitive. Local insight helps. It can turn a risky choice into a smart move.