Will NYC’s new mayor Mamdani cause a mass housing market exodus?

New York city is about to have a new mayor, one that could change everything for New York’s housing market. Zohran Mamdani is now overwhelmingly favored to become New York City’s next mayor — with prediction markets giving him over 90% odds of victory. If Mamdani is elected on November 4th, it could bring about a major sea change in NYC’s real estate market and economy, with his progressive platform on taxation, policing, and housing energizing his base but sparking deep concern across the city’s business and real estate sectors.

Particularly, some analysts warn that a Mamdani administration could trigger an exodus reminiscent of the pandemic years, when over 100,000 people fled Manhattan and more than 300,000 left the city at the height of 2021’s out-migration wave.

Will that happen again? And it does, could we see another mass departure of the city’s wealthy residents — and what would that mean for New York’s housing market?

“Phones ringing off the hook” in NYC Suburbs as Wealthy Residents look to flee

NYC’s wealth residents could already be looking to escape, according to a recent article from Realtor.com, which highlighted that real estate agents in Westchester County are seeing more inbound calls and showings in advance of the mayoral election. According to The Harrison Team at Compass, contracts in Westchester are up 15% YoY in October, with showing activity up 28.1% in the last four months.

The reason that some wealthy residents are now leaving NYC in anticipation of a Mamdani victory is that they fear higher taxes, a Mamdani has proposed increase the city’s income tax rate by a flat 2% for those earnings over 1 million. Moreover – some are also fearful that a Mamdani victory will increase crime in the city, due to his past criticism of police officers.

However, if there is “Mamdani Effect” occurring, it’s slow to show up in the data. According to home sales data on Reventure App, sourced from Redfin, there has yet to be an exodus from Manhattan’s housing market. Through September 2025, home sales in Manhattan were up 5.2% YoY, while sales in King County in Brooklyn were up +2.9% YoY. The Bronx and Queens registered declines.

Access Home Sales Data for your ZIP Code Now

New York City Home Prices already “crashed” from 2022 to 2024.

One aspect of New York City’s housing market the could result in a slower exodus than expected from a Mamdani victory is that home prices in Manhattan have already dropped significantly after the pandemic. In particular, home values in Manhattan are down nearly 20% over the last three years, experiencing a decline from $1.49 million for the typical home in September 2022 to $1.19 million in September 2025.

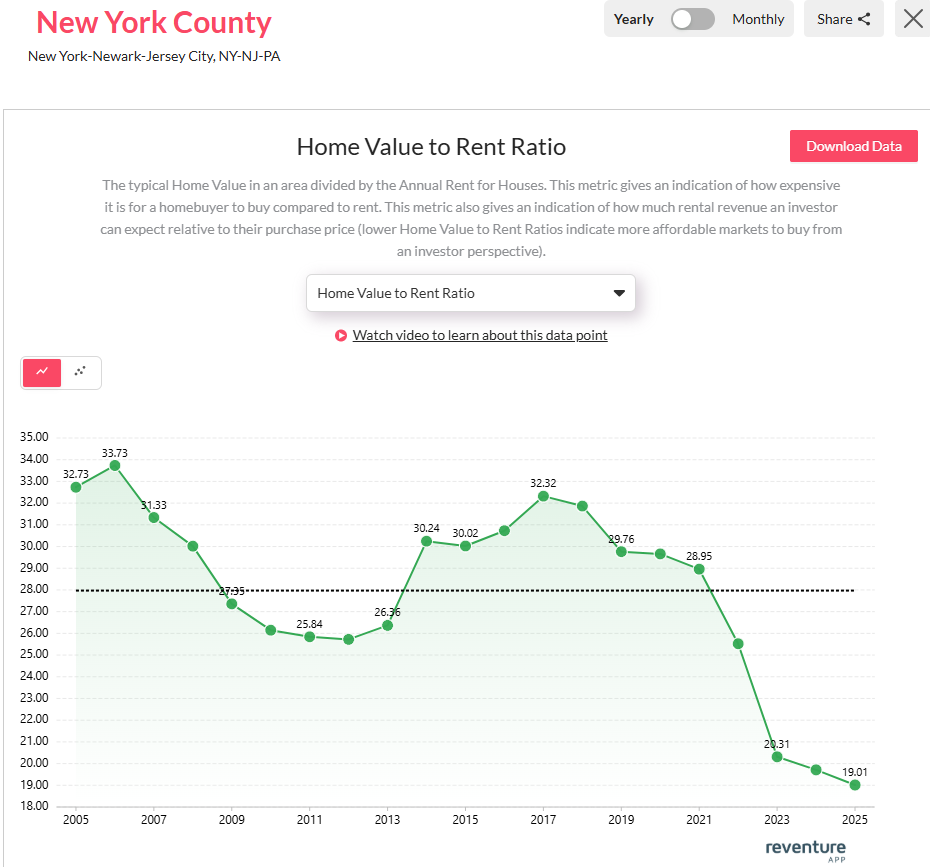

While these condo and home values in New York are still expensive, they’re significantly cheaper than they were three years ago, and in fact – they’re the cheapest they’ve been in decades relative to to income and rent.

For instance, Manhattan’s Home Value / Rent ratio today rests at 19.0x, which is about 30% below the long-term average, indicating that home price growth has failed to keep up with rent growth. In fact – home values in Manhattan today are barely above where they were in 2007 in nominal terms, creating strong buying opportunities for those with the finances to afford the $1+ million sticker price.

Upgrade to See Home Value/Rent Data in Your Area

Could it be a good time to buy in New York City’s housing market?

Begging the question: could it actually be a good time to buy in New York City’s housing market, contrary to the headlines suggesting another exodus is about to take place?

Reventure’s data shows that home values in Manhattan are 28% undervalued as of September 2025, while the Bronx is 17% undervalued, Brooklyn 4% undervalued, and Queens also 4% undervalued. While most housing markets across the U.S. in 2025 are significantly overvalued, New York City is the opposite, due to its home price underperformance during the pandemic. All the while, incomes and rents in New York kept growing, pushing the market to undervalued territory. Suggesting that now could actually be a good time to buy, and that these will be the best deals we’ll see in NYC real estate in quite some time.

Of course, buying in Manhattan isn’t for everybody. Even with the undervalued prices, it still costs over $1 million to buy the average condo or co-op, a sticker price that is out of reach for the vast majority of Americans. And if you were to buy with a mortgage it would be even less affordable, with the typical Mortgage + Tax + HOA payment in Manhattan running over $7,000/month.

How to use Reventure App to make a better home-buying decision in 2026

Reventure App is the only real estate platform that allows homebuyers and investor alike widespread access to reliable forecasts down the ZIP code level. Our users have saved $10,000s utilizing there forecasts, along with valuation and market data, to make more informed home-buying and investment decisions. In the case of New York City and Manhattan, Reventure’s data suggests home values will rise by +0.8% over the next 12 months, with the market being fundamentally undervalued today. This combines to suggest that NYC real estate is a buy right now. However, the exact story depends on your area. Upgrade to Reventure Premium to see the 12-month forecast and Valuation % in your city and ZIP code before buying, all for the low price for $49.