Will Declining Immigration in 2025 Negatively Impact the U.S. Housing Market?

Immigration is falling sharply in the United States this year. Some reports say it is down as much as 90% in 2025. That is a massive shift in a country where newcomers have long fueled growth.

You may wonder what this means for housing. Fewer people arriving could mean less demand. And less demand often cools prices. But will that actually happen here?

The housing market has been full of surprises in recent years. So the question is simple. If immigration keeps sliding, will it drag down demand and slow home price growth? Let’s figure it out.

Why Record Immigration May Not Mean Higher Home Prices?

From 2021 to 2024, immigration carried most of America’s population growth. In fact, about 84% of it came from people arriving from abroad. Natural population growth, measured by births minus deaths, slumped to historic lows. Immigration filled that gap.

With natural population growth collapsing, immigration drove nearly all U.S. population gains from 2021 to 2024. Access the above graph here. [Link]

The above lead graph by Reventure tells the story clearly. Births minus deaths have been sliding for more than a decade. By 2021, natural increase was barely keeping pace. Then it collapsed during the pandemic. Immigration, however, soared. By 2024, the U.S. recorded its highest level of immigration on record (past 2.8 million). That surge gave the country an important demographic lifeline.

At first glance, you might think this directly boosted housing. More people, more demand, right? The logic seems simple. Yet, it is not quite that straightforward.

According to John Burns Consulting, immigration’s impact on home buying is more muted than many believe. The bulk of newcomers first rent. Rental demand spikes, while for-sale demand does not jump as much. Their research found that from 2022 to 2024, almost all new renter households came from immigration. But most new homeowners came from people already living in the U.S.

So, while immigration numbers matter, their effect on home price growth may not be as powerful as headlines suggest.

Record Low Immigration Could Stall Apartment Demand

From 2022 to 2024, almost all growth in homeowner households came from native-born Americans. About 95% of the increase was domestic. Only 5% came from immigration. This shows that immigration has not been a major driver of homeownership demand. Most buyers are still people already living in the U.S.

The rental market tells a different story. According to John Burns, 100% of renter household growth during this period came from immigration. Every new renter household was tied to people arriving from abroad. That is a striking figure. It means immigration was the only source of rental absorption in those years.

Now look at today. Recent border crossing data shows immigration has fallen sharply in 2025. If this continues, the pipeline of new renters will dry up. Apartment demand could weaken as soon as late 2025 or early 2026. That would mark a dramatic shift in the rental market outlook.

Reventure App Rental Insights

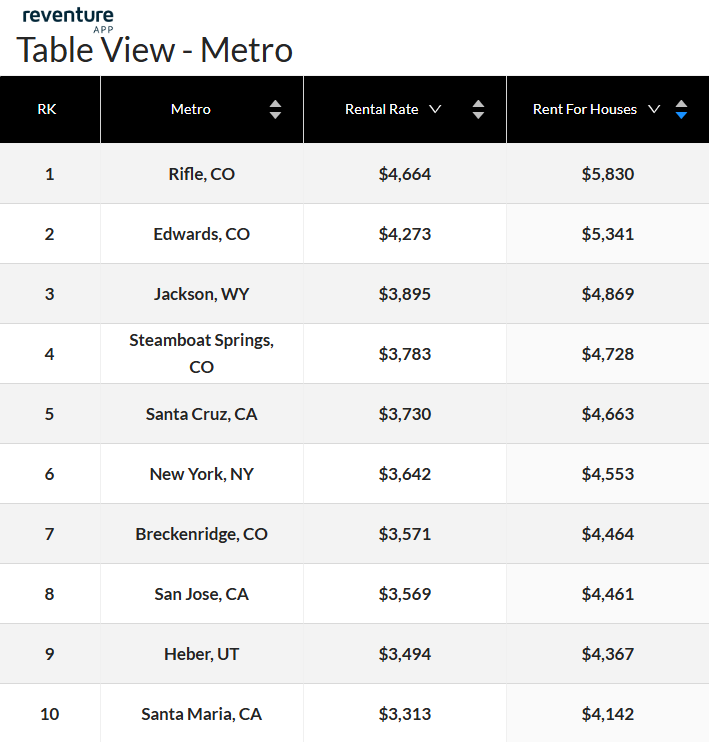

Rental markets in the U.S. show a stunning divide. On one side, small mountain and coastal towns top the charts with extreme housing costs. On the other hand, parts of the Midwest still offer bargain prices for renters.

Rifle, CO, tops the nation with rents above $5,800 for houses, while mountain and coastal towns dominate the highest-cost list. [Link]

Take Rifle, Colorado. The average rental rate is over $4,600, and renting a house climbs past $5,800. Edwards, Colorado, follows close behind, along with Jackson, Wyoming, and Steamboat Springs. Even Santa Cruz, California, and New York City land in the top tier, with rents well above $3,600 a month. These are lifestyle destinations, but they come with eye-watering price tags.

Sterling, IL, leads the most affordable markets, with house rents under $820, showing the sharp divide in U.S. rental costs. [Link]

Now compare that to Sterling, Illinois. Here, the average rent is only $650, with houses around $812. Cities like Greenville, Ohio, and Rolla, Missouri, fall in the same range, all under $1,000 for houses. Clinton, Iowa, and Indiana, Pennsylvania, also make the list of the most affordable.

The gap is clear. Some metros demand luxury-level rents, while others remain accessible for families and workers. If immigration slows, as current data suggests, demand may ease first in these high-cost rental markets. That could reshape the balance between expensive resort towns and affordable heartland communities.

If you want area-specific immigration and renting data, Reventure App provides insights down to the ZIP code for $49/ month. Buyers and renters can spot which neighborhoods are overpriced and which still offer value. Sellers can see where demand is still strong. The market feels cooler, but it is still competitive. Local insight helps. It can turn a risky choice into a smart move.