Why Cash Buyers Are Dominating Houston and San Antonio’s Housing Markets

Cash is king again in Texas. In 2025, nearly four in ten homes sold in Houston and San Antonio were bought entirely with cash. That’s well above the national average.

With mortgage rates still high, many buyers are skipping the banks. Cash offers close faster and face fewer risks. Wealthy buyers and investors are taking over, reshaping both cities’ housing markets. Traditional buyers who rely on loans are being pushed aside.

Texas has become a magnet for equity-rich movers seeking stability, investment opportunities, and long-term growth. Let’s get into the details:

Houston

Cooling Prices, Rising Competition

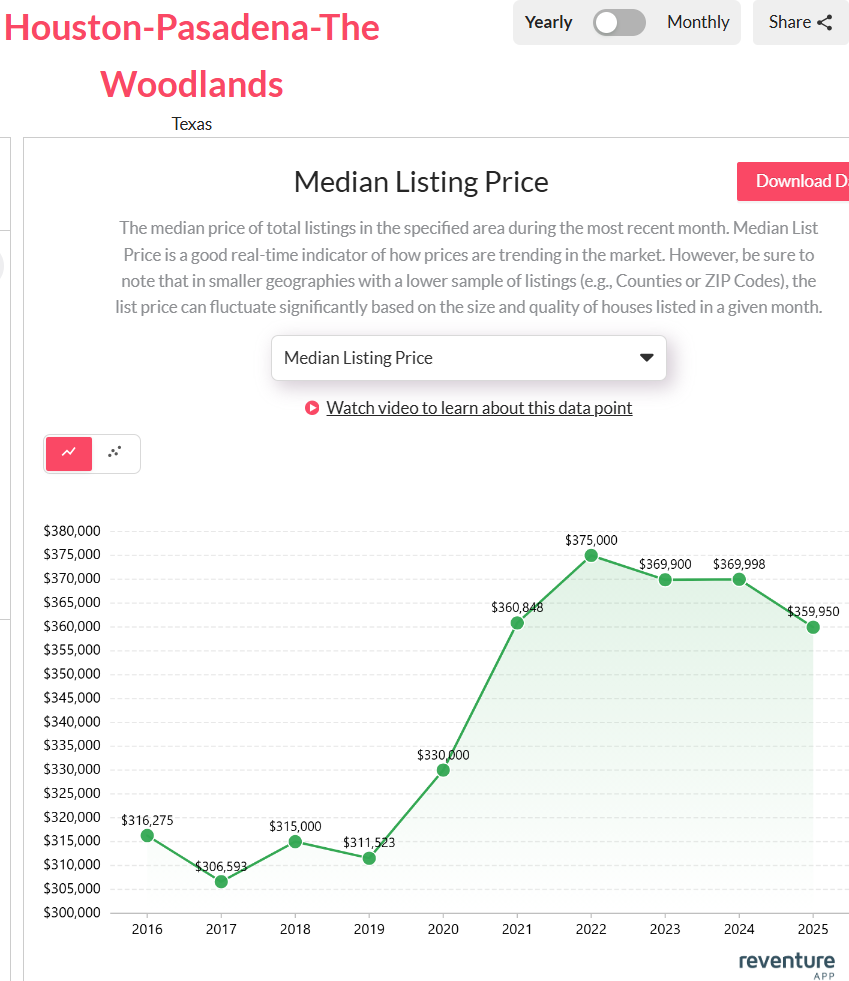

Houston’s housing market has seen a shift from its pandemic-era peak. The median listing price reached $375,000 in 2022, the city’s highest point in nearly a decade. Since then, prices have edged down. By 2025, the median listing price stands at $359,950. And that’s about 4% below last year and roughly $15,000 less than in 2022.

Houston home prices peaked at $375,000 in 2022 before easing to $359,950 in 2025. Access the above graph here. [Link]

Between 2016 and 2020, Houston’s market moved gradually. Prices stayed near the $310,000–$330,000 range. Then came a sharp jump in 2021, when listings climbed to $360,848. It’s a $30,000 surge in just one year. This growth was fueled by pandemic migration, investor demand, and ultra-low mortgage rates.

The recent dip indicates a normalization rather than a crash. Inventory has grown, and high interest rates have cooled buyer urgency. Yet, cash buyers remain active. They face less competition from financed buyers and use quick closings to their advantage. For sellers, cash means certainty. And that’s attractive in a slower market.

From Record Lows to a Gentle Rise

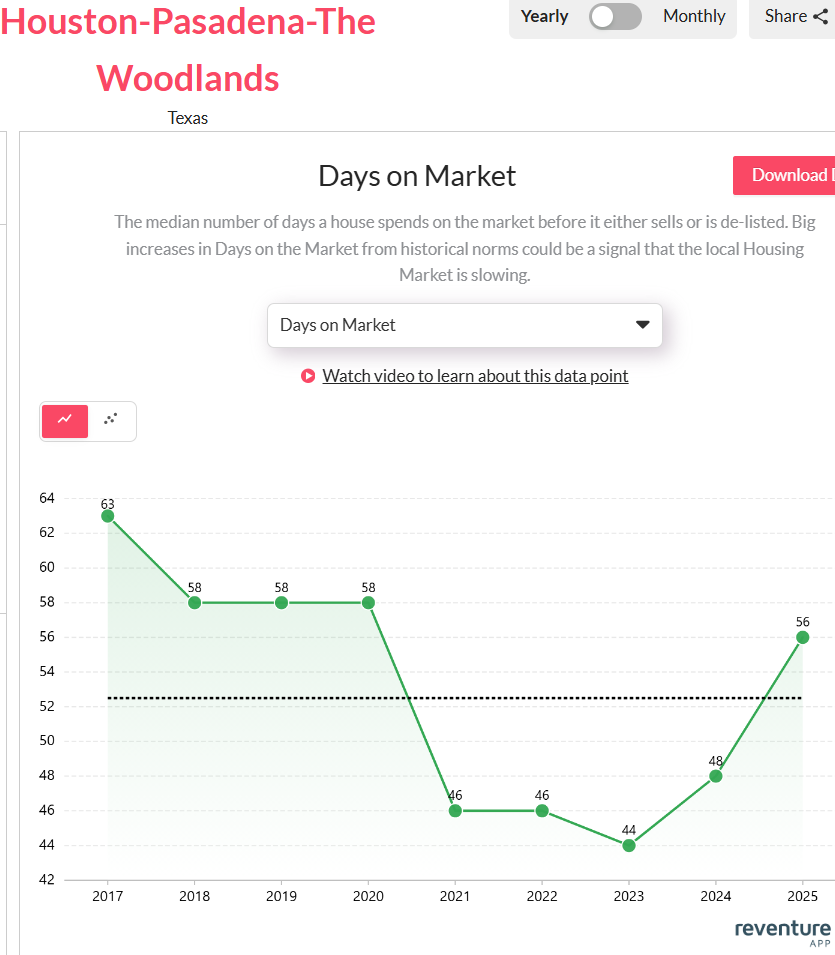

Homes in Houston are taking longer to sell again. The median days on market (DOM) dropped to a low of 44 days in 2023, the fastest pace in years. But in 2025, listings now spend about 56 days on the market. It is a 27% increase year-over-year.

Homes in Houston now take 56 days to sell, up from a record low of 44 days in 2023. Access the above graph here. [Link]

This upward shift reflects a market adjusting to affordability pressures. With mortgage rates still near 7%, financed buyers are cautious. Cash buyers, on the other hand, are driving much of the remaining activity. Their ability to close within days, not weeks, helps them secure deals even as demand slows.

The broader trend shows balance returning. From 63 days in 2017 to 44 days in 2023, Houston moved from a buyer’s market to a seller-favored one. The current rise to 56 days is a healthy correction, suggesting stability rather than weakness.

San Antonio

Affordability Still Has Its Edge

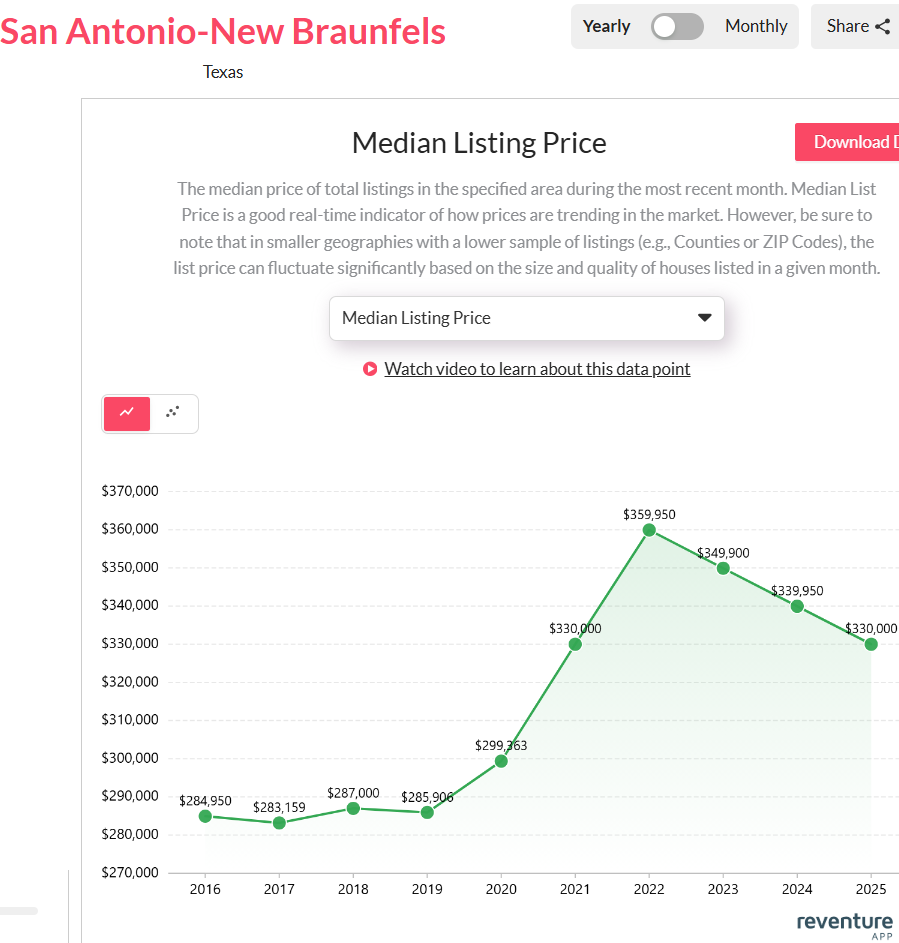

San Antonio’s story mirrors Houston’s but with its own rhythm. The median listing price peaked at $359,950 in 2022, matching Houston’s high point almost exactly. However, San Antonio’s correction has been steeper. As of 2025, the median price has fallen to $330,000, a $30,000 drop in two years.

San Antonio’s median listing price dropped from its 2022 high of $359,950 to $330,000 in 2025. Access the above graph here. [Link]

Even so, the market remains attractive. San Antonio homes are about $30,000 cheaper than those in Houston, keeping the city appealing for investors, retirees, and first-time buyers. Between 2016 and 2020, prices climbed slowly from $284,950 to $330,000, showing steady appreciation without volatility.

The dip since 2022 reflects affordability fatigue and rising supply, not a loss of interest. Many cash buyers see this as an entry opportunity. Lower prices and a growing rental market make San Antonio ideal for long-term investors and out-of-state purchasers looking for value.

Slow but Stable

San Antonio homes are taking longer to sell. The median DOM has risen from 51 days in 2023 to 73 days in 2025. It is a 43% increase in just two years. That’s the highest since 2017, when homes averaged 59 days before selling.

Listings in San Antonio linger longer, rising to 73 days on market in 2025. Access the above graph here. [Link]

The slowdown doesn’t mean demand has disappeared. Instead, it shows buyers negotiating harder and sellers adjusting expectations. Many financed buyers have stepped back due to high rates, leaving the field open for cash investors. These buyers, often seeking rentals or second homes, are keeping sales alive despite longer listing periods.

San Antonio’s DOM data explains that homes take longer to move. But they do move, especially when priced right or offered to cash buyers ready to act.

Final Thoughts

Houston and San Antonio are no longer red-hot markets, but they’re far from cold. Prices have cooled slightly, and homes take longer to sell. Yet the dominance of cash buyers keeps both markets active and competitive.

Houston offers scale and investment depth. And San Antonio offers affordability and long-term value. They represent how the Texas housing market is evolving in 2025. It is slower, steadier, but still driven by those who can pay in full.

If you want to see your state, metro, or county’s housing situation, buy Reventure Premium. For just $49 a month, you can access 40+ data points, from mortgage-to-income ratios to home values and inventory growth. And it offers 6x more accurate forecasts than Zillow. Because in a market that’s holding tighter than ever, precision isn’t a luxury.

Upgrade to Reventure Premium