America’s Demographic Shift That Will Reshape Housing

America’s Demographic Time Bomb: The Birth/Death Crossover That Will Reshape Housing

The U.S. is heading toward a demographic turning point that will reshape the housing market more than interest rates, inventory cycles, or even economic policy. By 2032, America will cross a threshold that few analysts discuss but every long-term housing investor should understand: more Americans will die each year than are born.

This “birth/death crossover” represents a structural shift in the country’s population dynamics—one that has been quietly building for decades. While the housing market has been supported by steady population growth throughout the 20th century and the early 2000s, that advantage is fading. Birth rates are falling, death rates are rising as the Baby Boom generation ages, and many states have already slipped into organic population decline.

The implications are profound. Fewer births today mean fewer households tomorrow. More deaths tomorrow mean more housing inventory entering the market. And the combination of these forces will reshape regional housing markets in ways that investors must begin preparing for now.

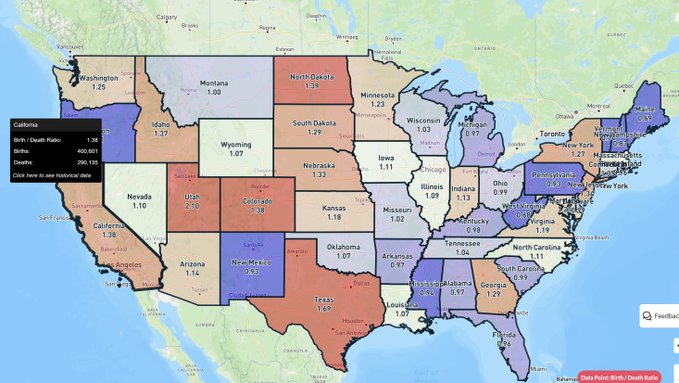

Reventure’s newly released Birth/Death Ratio data, under Demographic Data, available for every U.S. county, provides a clear lens into this future. And what it reveals is a country moving in two very different directions.

A Four-Decade Decline in U.S. Birth Rates

The seeds of the 2032 crossover were planted long ago. The U.S. birth rate has been falling since the early 1990s, dropping every decade and repeatedly hitting new lows in the 2010s and 2020s. The country’s fertility rate now sits at 54.5 births per 1,000 women, the lowest in recorded American history—lower than during the Great Depression or the years following World War II.

Several forces are driving this decline: delayed marriage, rising housing and childcare costs, career prioritization, urbanization, student debt, and a shift in lifestyle preferences. Fewer Americans are choosing to have children, and those who do are having fewer than past generations.

At the same time, the population is aging rapidly. The Baby Boomer generation—America’s largest—is entering a period of rising mortality. Death rates are increasing predictably and steadily each year. The mathematical result is unavoidable.

If current trends continue, the U.S. will move from a Birth/Death Ratio of 1.6 in the early 1990s to below 1.0 by 2032. That means the country will lose population organically, relying entirely on immigration and interstate migration to stay afloat.

What the Crossover Means for Housing

The demographic reversal will exert pressure on the housing market in three main ways.

First, long-term demand will soften

Historically, young families have driven homebuying. They purchase starter homes, move up to larger properties, and stabilize demand across metro areas. As birth rates fall, the pipeline of future buyers shrinks. The U.S. will see fewer 30- to 40-year-olds forming households in the 2030s and 2040s—a long-term drag on owner-occupied demand.

Second, aging homeowners will release inventory

The Boomer generation owns roughly one-third of all U.S. homes. As mortality increases, millions of these homes will return to the market, especially in older states with low fertility and limited inbound migration. This process won’t be sudden, but it will be steady—and it will add supply into local markets that may not have enough new demand to replace the loss.

Third, geographic divergence will intensify

Some regions will still grow because they attract migrants or have higher birth rates. Others will stagnate or shrink. In the past, demographic advantage was nearly universal across the U.S. Today, it is becoming highly uneven. Investors who assume “national trends” will miss the story entirely.

This regional divergence is already visible in the Birth/Death Ratio data.

State-Level Contrasts: Two Americas Emerging

Reventure’s county-level demographic dataset, sourced from the US Census Bureau, illustrates the split clearly.

California: Still Growing, But Slowly

California posts a Birth/Death Ratio of 1.38—more births than deaths. But the state’s organic growth has fallen dramatically from the early 1990s, when the ratio was 2.86. This long-term decline—cut in half over 30 years—helps explain why the state now relies heavily on migration to maintain its population base.

Florida: Already in Organic Decline

Florida, a magnet for inbound migration, has crossed into a negative Birth/Death Ratio at 0.96—more deaths than births. Without new residents moving in, Florida’s population would already be shrinking. The state’s heavy reliance on older residents means future inventory release will be significant.

These state-level numbers are informative, but the metro-level data is even more revealing.

Austin vs. Tampa: A Preview of the Housing Market’s Future

Two fast-growing metros—Austin, Texas and Tampa, Florida—offer a clear example of divergent demographic futures.

-

Austin’s Birth/Death Ratio: 2.19

-

Tampa’s Birth/Death Ratio: 0.90

Austin has 119% more births than deaths, a sign of a young, growing population. Tampa has 10% more deaths than births, meaning it depends entirely on inbound migration to maintain demand.

These ratios explain the long-term trajectories of each market:

Austin’s demographic profile supports continued household formation.

Demand for starter homes, townhomes, and family-oriented suburban neighborhoods should remain strong through the 2030s.

Tampa’s demographic profile points toward increased future inventory.

As its older population ages out and death rates rise, Tampa will see more homes return to the market. Without strong inbound migration, demand could flatten.

For investors and homebuyers, the message is clear: birth/death dynamics are destiny. And they are now available at the county level for the entire country.

Why Reventure Built the Birth/Death Ratio Dataset

Demographics move slowly, but they determine everything from housing cycles to labor supply to migration patterns. Yet this data is rarely accessible in a clear, visual format.

Reventure built the Birth/Death Ratio tool to solve that problem.

The platform allows users to:

-

Track 30 years of birth and death trends for every county

-

Compare metros to identify long-term winners and losers

-

Evaluate risk from aging-out inventory

-

Spot markets already entering organic population decline

-

See where future homebuyer demand will be strongest

For anyone making real estate decisions—whether buying a home, investing in rentals, or building a portfolio—this data provides a crucial advantage.

The 2032 crossover is approaching. But its effects are already visible today. Demographic momentum is shifting, and the housing market will shift with it.

A Market Redefined by Demographics

The U.S. housing market has benefited from demographic tailwinds for nearly a century. Those tailwinds are fading. The birth/death crossover will not cause an immediate crash or sudden shock, but it will fundamentally alter the balance of supply and demand over the next decade.

-

Some regions will thrive

-

Others will stagnate

-

Inventory patterns will change

-

Buyer pools will shrink

-

Migration will matter more than ever

Understanding these changes begins with understanding the Birth/Death Ratio. And for the first time, it’s fully available—down to the county level—on Reventure.

The demographic future of U.S. housing has already arrived. Investors who see it now will be better positioned than those who wait until it shows up in the prices. Upgrade to premium now for only $49 to see the full Birth/Death data set by county, metro, and state, along with our short-term price forecast.