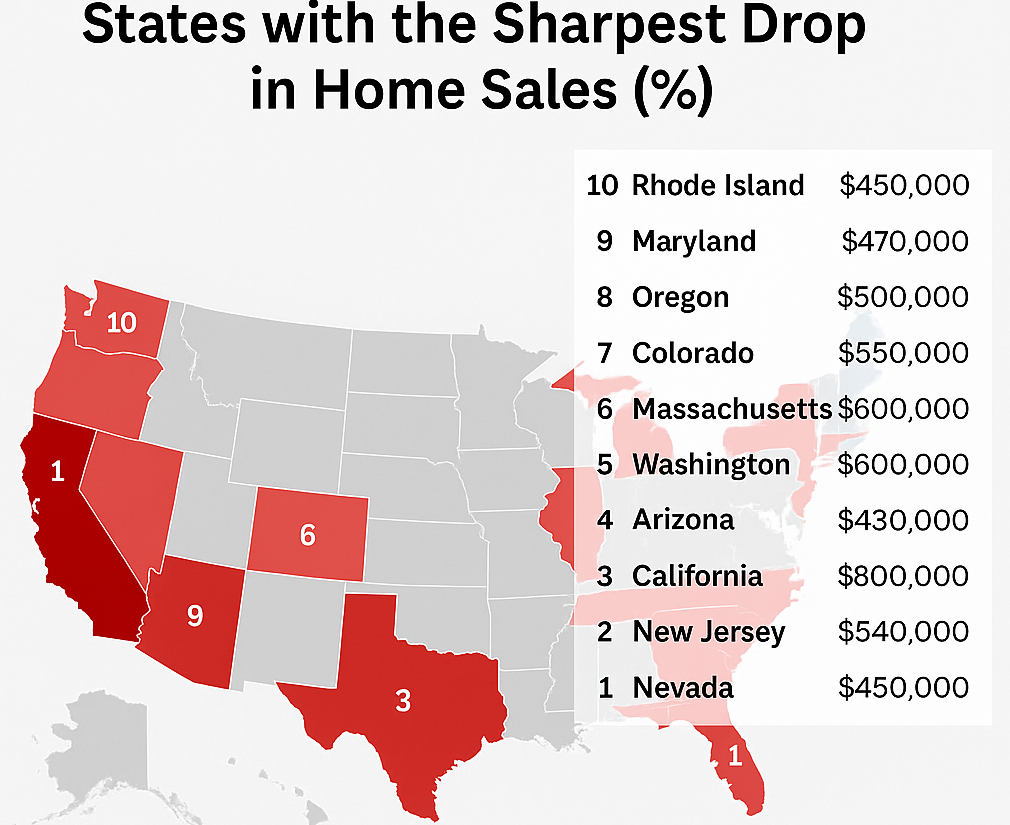

Top 10 States Where Home Buyers are on Strike (Where Sales Have Dropped the Most)

Homebuyers aren’t just slowing down. In many states, they’re stepping back completely. Sales are falling fast, and the trend is hard to ignore.

It’s not just a dip in numbers. It’s a sign of frustration, high costs, and a market that feels out of reach. Some states are feeling the hit more than others.

Let’s look at where the drop is sharpest, and why it matters if you’re planning to buy.

10. Rhode Island

Rounding out the list is Rhode Island, where sales are down 30 percent. This small state has seen big price gains, with typical homes now over $450,000. For locals who rely on modest incomes, the strike is real. Buyers are waiting for a better entry point.

9. Maryland

Maryland has dropped 31 percent as well. The suburban areas around Washington, D.C., have seen rapid price increases, pushing values toward $470,000. For many first-time buyers, it has simply become unaffordable. The slowdown reflects the frustration.

8. Oregon

Oregon has seen sales fall 31 percent. Portland’s housing boom has cooled sharply. Homes now cost close to $500,000 on average, and affordability is stretched to the limit. Families are waiting, hoping prices will come back down to earth.

Nick Gerli, CEO of Reventure App, shows how home sales in pricey states have plunged over 30% since 2019. Access the above graph here. [Link]

7. Colorado

Colorado is also showing deep declines, with sales off by 32 percent. Denver was one of the hottest markets during the pandemic, but affordability has collapsed since then. Average home values near $550,000 are leaving many buyers on the sidelines.

6. Massachusetts

Massachusetts is not far behind. Sales are down 33 percent. Boston has long been expensive, but the pandemic pushed values even higher. With homes now averaging above $600,000, many potential buyers are priced out completely. Demand is shrinking, and the strike is visible.

5. Washington

Washington has seen sales collapse by 34 percent. Seattle and its suburbs pushed prices to dizzying heights, with home values around $600,000 today. Affordability is at record lows, and buyers are holding back. Even with a strong tech-driven economy, demand cannot keep up with the costs.

4. Arizona

Arizona’s market has cooled dramatically. Sales are down 34 percent, wiping out much of the pandemic boom. Phoenix once drew buyers with lower costs, but those days are over. Typical home values have climbed above $430,000, and buyers are resisting the sticker shock.

3. California

California is also down 34 percent. The state has the highest home values in the country, averaging close to $800,000. For buyers in Los Angeles, San Diego, or San Francisco, the math has simply broken down. Even strong job markets cannot offset mortgage payments that eat up nearly half of household income.

2. New Jersey

New Jersey has seen a 34 percent decline. Homes here cost well over half a million dollars on average. Add some of the highest property taxes in the nation, and the burden becomes too heavy for many families. Demand is drying up, even in once-competitive suburbs.

1. Nevada

Nevada tops the list with sales down nearly 37 percent. That is more than one in three buyers gone compared to 2019. Home values in Las Vegas surged during the pandemic, but affordability has collapsed. With average prices around $450,000, the slowdown is unmistakable.

Final Takeaway

The pattern is clear. The steepest declines are concentrated in the states with the highest prices. Mortgage rates alone do not explain the collapse. Affordability does. When payments take up more than 40 percent of income, buyers step back.

If you want to dig deeper, there’s a way to get far more precise insights. With the Reventure premium plan, you can track affordability down to the metro and even zip code level. It’s $49 a month, less than 0.02 percent of the cost of buying a home.

And it gives you six times more accurate forecasts than Zillow. You’ll unlock 40+ data points, from income-to-value ratios to inventory shifts and price projections. For anyone serious about buying in the right place at the right time, that kind of data could make all the difference.

One Response