Top 10 Most Buyer-Friendly Housing Markets for the Fall of 2025

Fall is here, and so are some of the best opportunities for homebuyers in years. A lot of them are in Florida. Prices are already slipping, and there’s plenty of inventory to choose from. Sellers know that fall and winter can be slower, so they’re more willing to cut deals before the year ends.

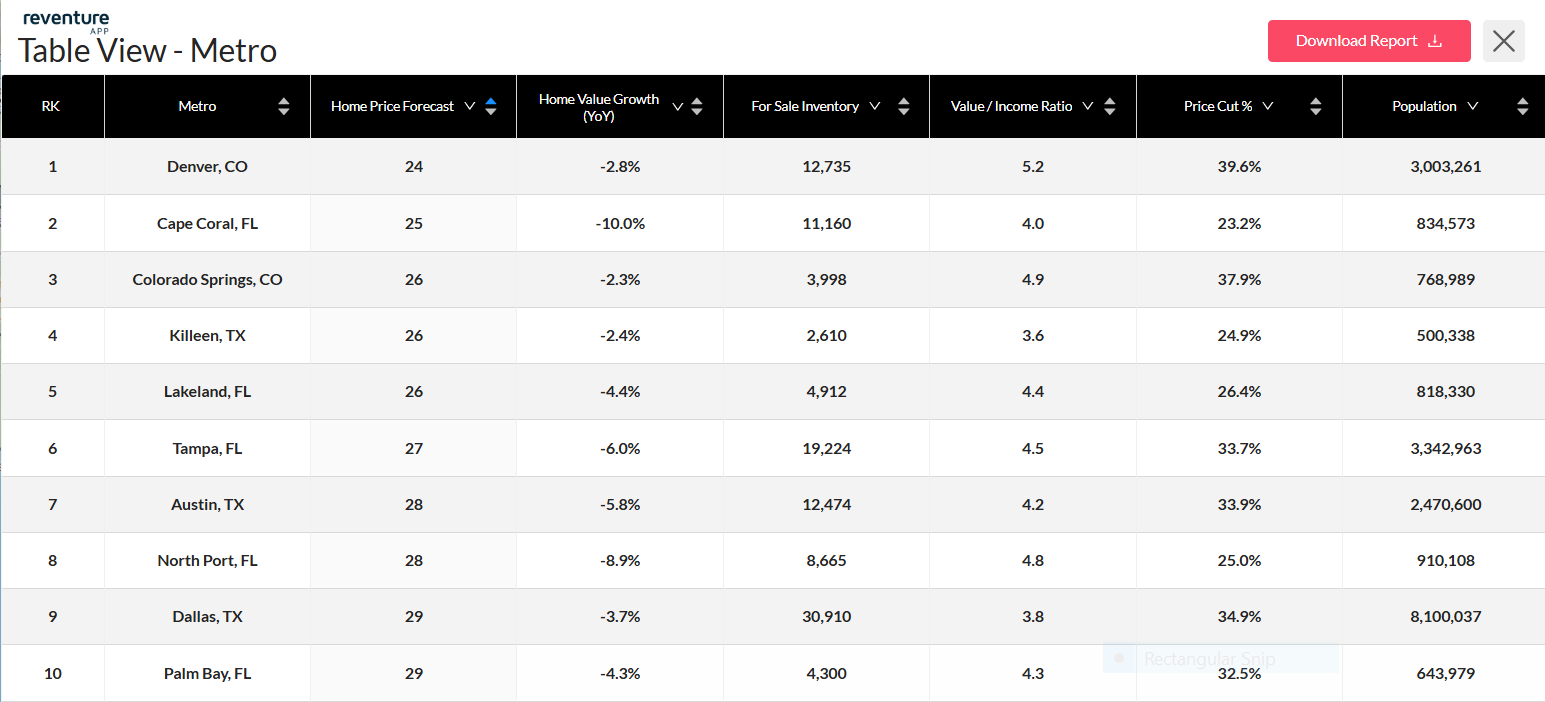

And that means many of today’s big metros are well below that line. The key is the Reventure Forecast Score. It runs from 0 to 100. A score of 45–55 means stability. Below 45 points to a declining market, with reduced demand, more sellers, longer days on market, and price cuts.

Let’s figure out those metros using Reventure’s price forecast score:

10. Palm Bay, FL (Score: 29)

Palm Bay rounds out the list with a forecast score of 29. Prices dropped -4.3% YoY. One-third of listings are cut. Inventory is 4,300 homes. The area’s market is adjusting after pandemic-era gains, as higher rates cool demand. Buyers can now move at their own pace and demand better terms without competition pressure.

9. Dallas, TX (Score: 29)

Dallas is the biggest metro on this list. Forecast score is 29. Prices are down -3.7% YoY. Nearly 35% of homes have a price cut. Inventory is massive: 30,910 listings. For buyers, choice and negotiation power are both strong. The city’s growing new construction supply has tipped the balance toward buyers. With sellers under pressure, price flexibility is the best it’s been in years.

Florida leads buyer-friendly markets with more homes, lower prices, and motivated sellers. Access the above table here. [Link]

8. North Port, FL (Score: 28)

North Port shows one of Florida’s steepest drops. Score is 28. Prices are off -8.9% YoY. About 25% of sellers have cut prices. With 8,665 homes listed, buyers have more leverage than ever. The surge in listings has softened competition and cooled bidding wars. For buyers, that means a rare chance to secure better deals in a previously overheated market.

7. Austin, TX (Score: 28)

Austin was once red-hot. Now it’s cooling off. Score is 28. Prices are down -5.8% YoY. About 34% of listings are discounted. Inventory is huge at 12,474 homes. Buyers no longer face the frenzy that defined Austin during the pandemic. Rapid price appreciation during the tech boom has reached its limit. Today’s buyers can shop patiently as the market resets from pandemic highs.

6. Tampa, FL (Score: 27)

Tampa is a major metro turning buyer-friendly. Score is 27. Prices are already down -6% YoY. One in three listings has a cut. More than 19,000 homes are on the market. After years of bidding wars, Tampa buyers finally have the upper hand. The mix of slower in-migration and affordability fatigue is cooling demand. Buyers can negotiate confidently as sellers adjust to a slower pace.

5. Lakeland, FL (Score: 26)

Lakeland joins Florida’s buyer-heavy club. The score is 26. Home values are down -4.4% YoY. About 26% of listings show price reductions. Inventory sits at 4,900 homes. The city’s affordability edge over nearby Tampa is narrowing. Buyers can use that to push for discounts or upgraded terms.

4. Killeen, TX (Score: 26)

Killeen is Texas’s most buyer-friendly metro. Forecast score is 26/ 100. Prices are off -2.4% YoY. One in four sellers is cutting prices. With just 2,610 listings, supply is smaller, but demand has weakened enough to tilt the power to buyers. Military relocations and slower population growth have cooled activity. It’s now a calm, negotiable market instead of a frenzy.

3. Colorado Springs, CO (Score: 26)

Colorado Springs mirrors Denver’s weakness. The score sits at 26. Prices are down -2.3% over the past year. Nearly 38% of homes have price cuts. Inventory is close to 4,000 homes. This market is cooling fast. The city’s price gains during the pandemic outpaced local wages, and that gap is closing. Buyers are returning cautiously, knowing sellers are more flexible than before.

2. Cape Coral, FL (Score: 25)

Cape Coral is seeing a real correction. Home values dropped -10% YoY. The score is just 25. More than 11,000 homes are on the market. Almost a quarter of sellers have cut prices. Buyers are firmly in control here. The market is cooling after years of double-digit appreciation driven by migration. Buyers have an edge again and can find serious price adjustments in once-hot neighborhoods.

1. Denver, CO (Score: 24)

Denver is the most buyer-friendly big market right now. A score of 24 is deep in decline. Prices are already down -2.8% YoY. Nearly 40% of listings have a price cut. Inventory is high at 12,735 homes. Buyers here have leverage and plenty of options. The mix of rising mortgage costs and slower job growth is reshaping demand. Buyers here now hold the cards in negotiations once dominated by sellers.

Why Fall and Winter Give Buyers the Edge?

The fall and winter months often deliver the best deals in real estate. Why? Sellers know demand cools as the year winds down. They’re more willing to cut prices, accept lower offers, and move on.

This seasonal trend is even stronger in today’s buyer-friendly markets. High inventory and falling prices already put pressure on sellers. Add in the slow season, and the power shifts further toward buyers.

We discussed that when comparing Zillow’s 2026 forecast to Reventure’s. Zillow leaned on tight supply to keep prices up, while Reventure flagged weaker demand and more price cuts ahead.

If you are a buyer and want the exact forecast for your ZIP get Reventure’ premium. That’s because Reventure’s housing forecast is performing 6x better than Zillow’s. And with the Premium Plan ($49/month), you get 12-month ZIP Code forecasts plus 40+ data points. And that is less than 0.02% of the cost of buying a home.

Upgrade to Reventure Premium

One Response