Reventure’s 2025 Housing Forecast Review: A Look Back at Our Performance

Twelve months ago, Reventure App released its 2025 U.S. Housing Market Forecast — a data-driven outlook built on real-time indicators such as inventory, price cuts, days on market, and migration trends. Our goal was simple: create a forecasting platform that outperforms legacy models by focusing on fundamentals.

With one month remaining in 2025, Reventure App is conducting a full retrospective on our housing market forecasts—evaluating their accuracy, benchmarking them against competitors, and highlighting how our models performed nationally, statewide, and metro-by-metro.

At Reventure, transparency isn’t optional—it’s core to our mission. Our forecasts are the foundation of the insight we provide to homebuyers, sellers, and investors making major financial decisions. Today, we’re proud to report that Reventure delivered the #1 U.S. housing forecast of 2025, outperforming every major national real-estate forecaster — including Zillow, Redfin, CoreLogic, and Goldman Sachs.

Reventure Delivered the #1 U.S. Housing Forecast of 2025

On December 28, 2024, Reventure released its first-ever national home price forecast, anticipating that U.S. home values would grow 0.9% in 2025. Our analysis pointed to a cooling market—rising inventory, increasing days on market, and slowing demand.

The actual outcome?

The Zillow Home Value Index (our benchmark) rose 0.06%, meaning Reventure’s forecast came within 0.85 percentage points, the closest margin of any competitor.

Competitors such as Zillow, Redfin, CoreLogic, Goldman Sachs, and Wells Fargo all projected significantly stronger growth and overshot their benchmarks by an average of more than 2.5 percent. Even when measured against a blended benchmark of Zillow, Case-Shiller, and NAR, Reventure’s forecast remained extremely close to reality, trailing by only 0.24 percent while competitors missed by nearly 3 percent.

On average, competing forecasts overshot the market by 2.57%, nearly 3x the error rate of Reventure.

When comparing our results to a blended benchmark of Zillow, Case-Shiller, and NAR, Reventure was even closer—trailing by only 0.24%, while competitors missed by an average 2.79%.

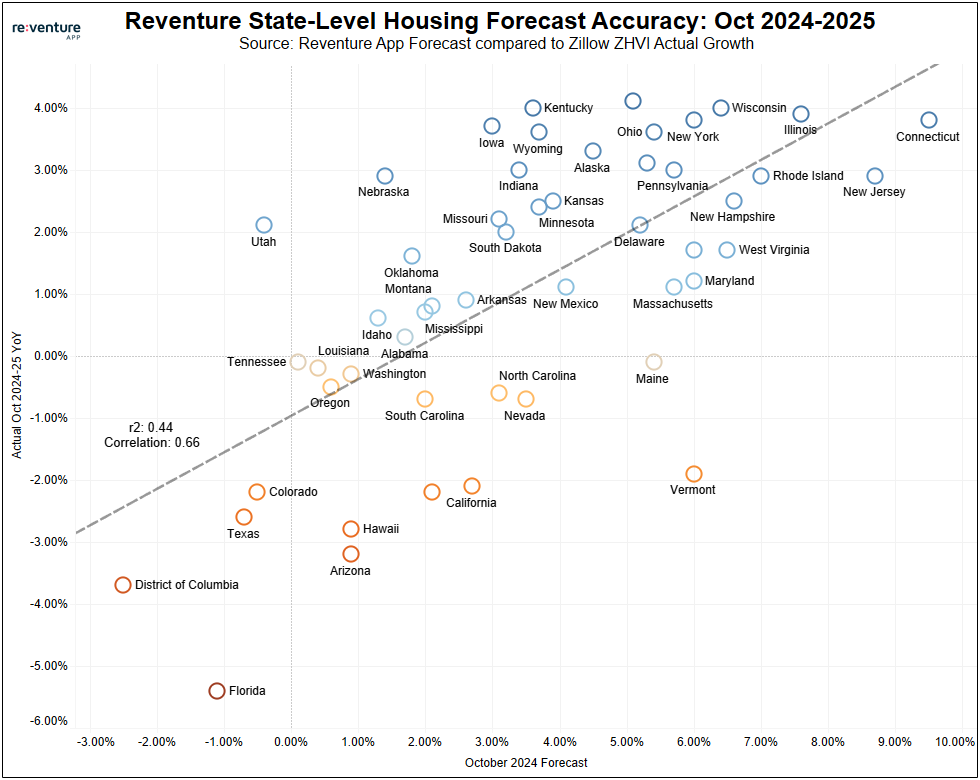

State-Level Forecasts: Accurate Trend Detection and Market Dispersion

Reventure’s state-level predictions also performed very well, correctly identifying the states that would underperform in 2025 — including Florida, Texas, Colorado, and Washington DC — and highlighting the states that would emerge as strong performers, such as Connecticut, New Jersey, Rhode Island, and Illinois. Someone following our state-level forecasts could have meaningfully repositioned their housing exposure and captured the regional divergence in performance this year.

Our median state-level error rate was -1.90 percent, meaning values came in slightly lower than our estimates for the typical state. While we accurately predicted the overall dispersion between outperforming and underperforming states, we could have improved our precision on the absolute growth figures. We also missed on a few smaller New England markets, such as Vermont and Maine, where limited inventory caused values to soften instead of rising as expected.

Moreover, we did “miss” on several states. They include Vermont and Maine, where our forecasts were +5-6%, however values in these areas trended down slightly. These smaller New England states operate a bit different from the rest of the U.S. housing market, and don’t require as much as inventory to come back on the market to slow down price growth.

Despite these challenges, Reventure’s state-level forecasts produced a correlation coefficient of 0.66 and an r-squared of 0.44. Excluding Vermont and Maine, those measures increase to 0.72 and 0.52, demonstrating a very strong ability to capture relative performance across the country.

Metro-Level Forecasts: Exceptional Accuracy and Major Outperformance

Forecast accuracy improved even further when we turned to metro areas. Across the 109 largest U.S. metros with a population above 500,000, Reventure’s home price forecasts achieved a correlation coefficient of 76 percent — more than six times higher than Zillow’s forecast accuracy at the same level of geographic detail.

We correctly identified the markets that would outperform in 2025, including Hartford, Bridgeport, Albany, Syracuse, and Cleveland. These metros continued to show price strength even as overall national momentum slowed, something few other analysts anticipated early in the year. At the same time, Reventure called the declines across Florida and Texas metros — including Cape Coral, North Port, Tampa, Austin, Lakeland, Orlando, Dallas, and San Antonio — as well as slowdowns in Denver, Colorado Springs, Memphis, and Nashville.

The median metro-level error rate was +2.50 percent. This larger error compared to the national and state forecasts reflects the unexpectedly sharp weakening in several Sun Belt metros during early 2025. Even so, our metro-level forecasts substantially outperformed competing models and provided homebuyers and investors with a far more accurate picture of how different regions were likely to behave.

Throughout 2025, we continuously compared our metro-level forecast to Zillow’s, which is the only other publicly available metro-level projection in the industry. Early in the year, it became clear that Reventure’s model was outperforming Zillow’s by a factor of six in times in correlation accuracy. This level of precision allowed Reventure to see the true dispersion in metro-by-metro home price trends—insight that proved invaluable for homebuyers and investors trying to anticipate where the market was moving.

ZIP-Code Level Forecasts are less accurate than National/State/Metro Forecasts

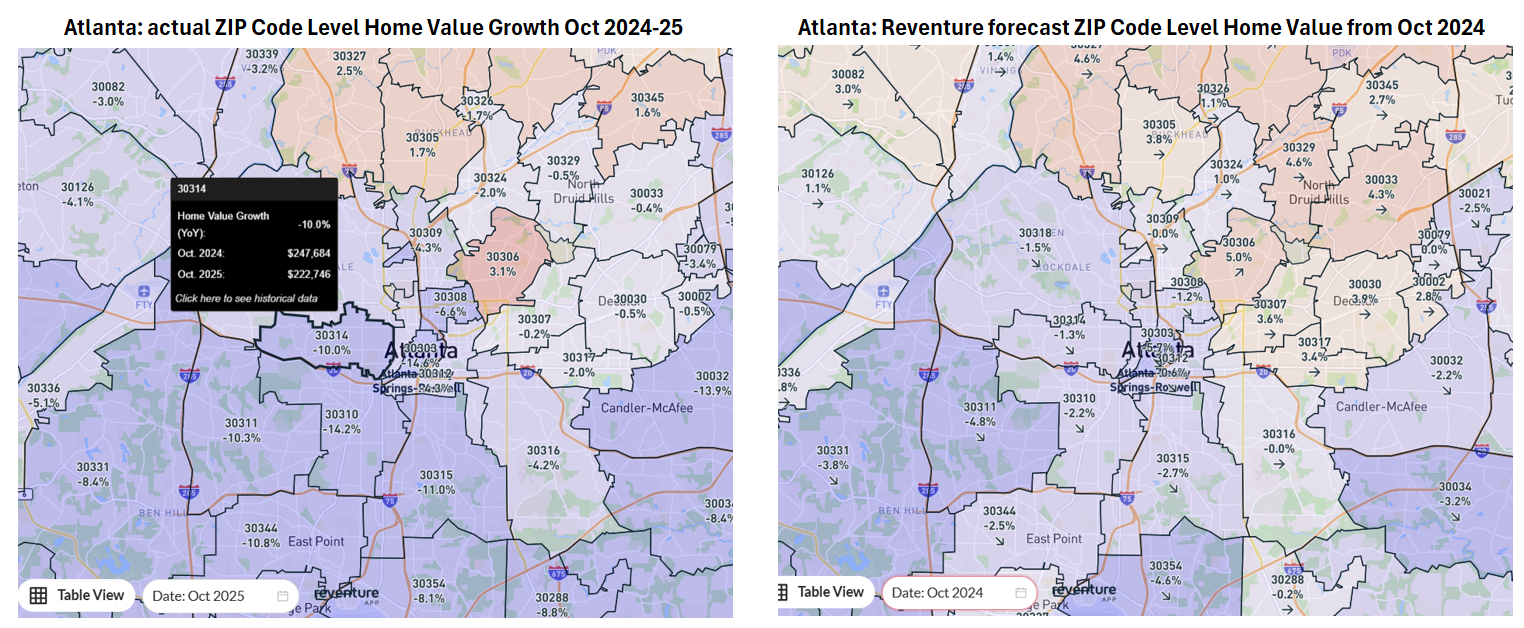

ZIP-code forecasts, while directionally useful, were less precise than forecasts at the national, state, and metro levels. This is natural, as ZIP-code markets contain far fewer transactions, making them more volatile and more sensitive to isolated events such as forced sales.

Correlations at the ZIP level were approximately 30 to 40 percent lower than those at broader geographic scales. Even so, the model correctly predicted local patterns that emerged within major metros such as Atlanta, Dallas, and Phoenix.

The snapshot below shows how Reventure’s forecast across the Atlanta metro in late 2024 nailed the neighborhood-level dispersion of home value growth, as well as the areas where values would go up and down.

In South Atlanta, for example, a concentrated investor sell-off pushed prices down much faster than expected, contributing to the higher error rate in several ZIP codes.

Reventure is enhancing its ZIP-level forecasting system for 2026 with the integration of new data related to mortgage defaults, foreclosures, and sales velocity. These additions are designed to improve precision in smaller geographies and better capture localized risk factors that traditional housing datasets overlook.

2026 Forecast to be Released Shortly

Reventure will release it’s 2026 Home Price Forecast for the U.S. Housing Market and the 50 States later this month. Stay tuned for that, and in the meantime, access the forecast data down to your city and ZIP code at www.reventure.app under a premium plan.

One Response