Palms Bay, FL Housing Market Update in 2025

Palm Bay’s once red-hot housing market has officially cooled in 2025. With home values falling, inventory rising, and price cuts surging, Brevard County is now firmly in buyer’s market territory. This article breaks down the latest trends, key figures, and forecasts shaping the Palm Bay metro. It will help buyers, sellers, and investors understand what’s driving the downturn and how to navigate the shifting real estate situation.

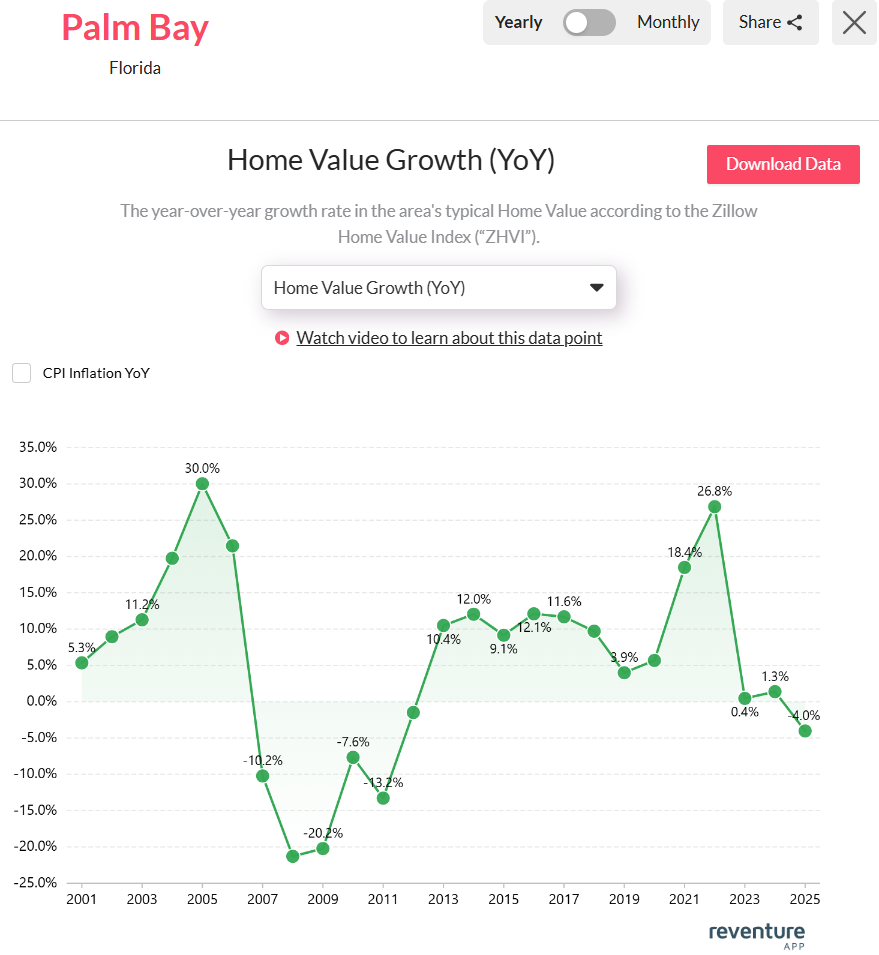

Palm Bay, FL’s Home Value Growth YoY Reached -4.0% in 2025

Palm Bay’s housing market is showing signs of cooling off in 2025, with the year-over-year home value growth rate dropping to -4.0%. This marks the metro’s first annual price decline since the post-pandemic boom, suggesting a clear shift in buyer sentiment.

Palm Bay, FL’s home value growth declined to -4.0% in 2025. Access the home value YoY growth graph of the metro here. [Link]

After hitting a record high of 26.8% growth in 2022, followed by a sharp slowdown to just 0.4% in 2023, the market appears to have entered a correction phase. Rising mortgage rates, affordability challenges, and tighter lending standards have likely played a role in pushing demand down and moderating prices.

This downturn also reflects broader national and Florida-wide trends where overheated housing markets are beginning to adjust. While Palm Bay remains a desirable destination for many due to its coastal lifestyle and affordability relative to other Florida cities, price growth may continue to slow unless economic or interest rate conditions shift favorably.

For buyers, the decline could present new opportunities. For sellers, however, pricing competitively and adjusting expectations may be necessary in 2025’s softening market.

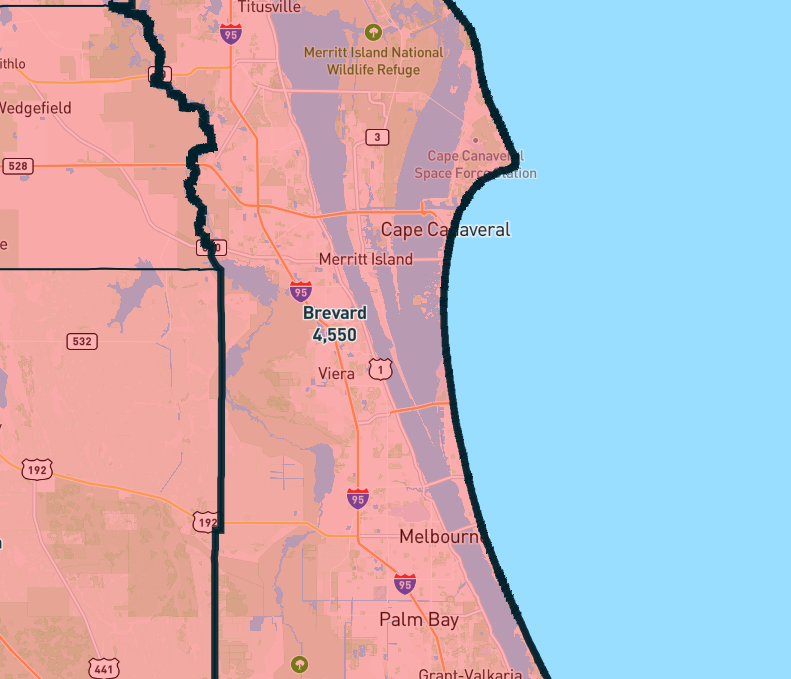

Housing Market Trends in Brevard County in Palm Bay, FL in 2025

The housing market in Brevard County, which includes Palm Bay, is undergoing a notable correction in 2025. Home values have declined to -4.0% year-over-year, indicating a shift from the rapid appreciation seen during the post-pandemic boom.

Brevard’s sales inventory reached 4,550 in the Palm Bay, FL, metro area. Access the above map here. [Link]

Inventory has risen sharply, with 4,550 homes currently listed for sale. This increase in supply is giving buyers more options and slowing down price competition. Sellers are also adjusting expectations, as 33.0% of listings have undergone price cuts, one of the highest rates in Florida.

According to data available on Reventure App, homes are taking longer to sell, with the average days on market now at 72. This suggests a cooling in buyer urgency and reflects changing dynamics as affordability becomes more challenging.

Despite the downturn, the market remains overvalued by 10.7%, indicating prices are still elevated relative to historical norms and local income levels. With a population of nearly 644,000, Brevard County remains a major housing market in Florida. However, buyers and sellers alike must navigate this period of recalibration with caution and flexibility in 2025.

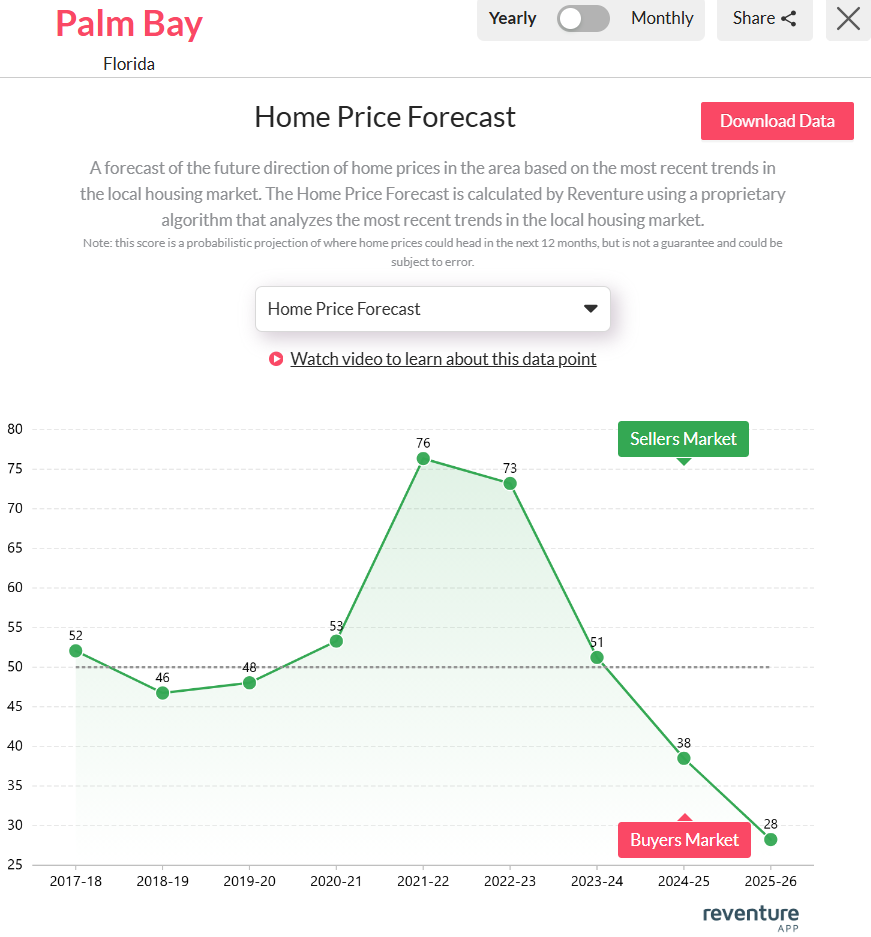

Palm Bay, FL’s Housing Market Predictions for 2025 – 2026

The Palm Bay, FL, housing market is projected to decline severely throughout 2025–2026. According to the Reventure App, the Home Price Forecast Score for the metro stands at just 28 out of 100, indicating that it is now a completely buyers’ market. On Reventure App, a score below 45 denotes a declining market, 45–55 suggests stability and scores above 55 reflect appreciation.

Palm Bay, FL’s Home price forecast score reached 28/ 100 in 2025. Access the home price forecast score chart here. [Link]

The steep drop from a peak score of 76 in 2021–22 to only 28 by 2025–26 highlights extreme cooling in the market and highly reduced buyers’ demand. This downturn suggests more negotiating power for buyers, while sellers must price competitively and stay flexible to close deals. Both homeowners and investors should prepare for further weakening and reassess their strategies in this evolving market situation.

For buyers, sellers, and investors navigating Palm Bay’s shifting market, timing and insight are everything. With Reventure’s premium plan for just $39/month, you gain access to state, metro, county, and ZIP code–level forecasts on inventory, pricing, value trends, and market strength. Whether you’re planning to buy smart, sell competitively, or track future moves, Reventure delivers the local data edge you need to stay ahead.