Myrtle Beach, SC, Housing Market Update in 2025

Myrtle Beach, SC, is facing a notable housing market cooldown in 2025. After years of rapid post-pandemic appreciation, the region has entered a buyer-friendly phase marked by falling home values, increased inventory, and longer listing times.

This detailed market report analyzes key data trends from Reventure App, including YoY value changes, price cuts, county-level breakdowns, and forecasts for 2026, equipping buyers, sellers, and investors with insights to navigate the shifting landscape.

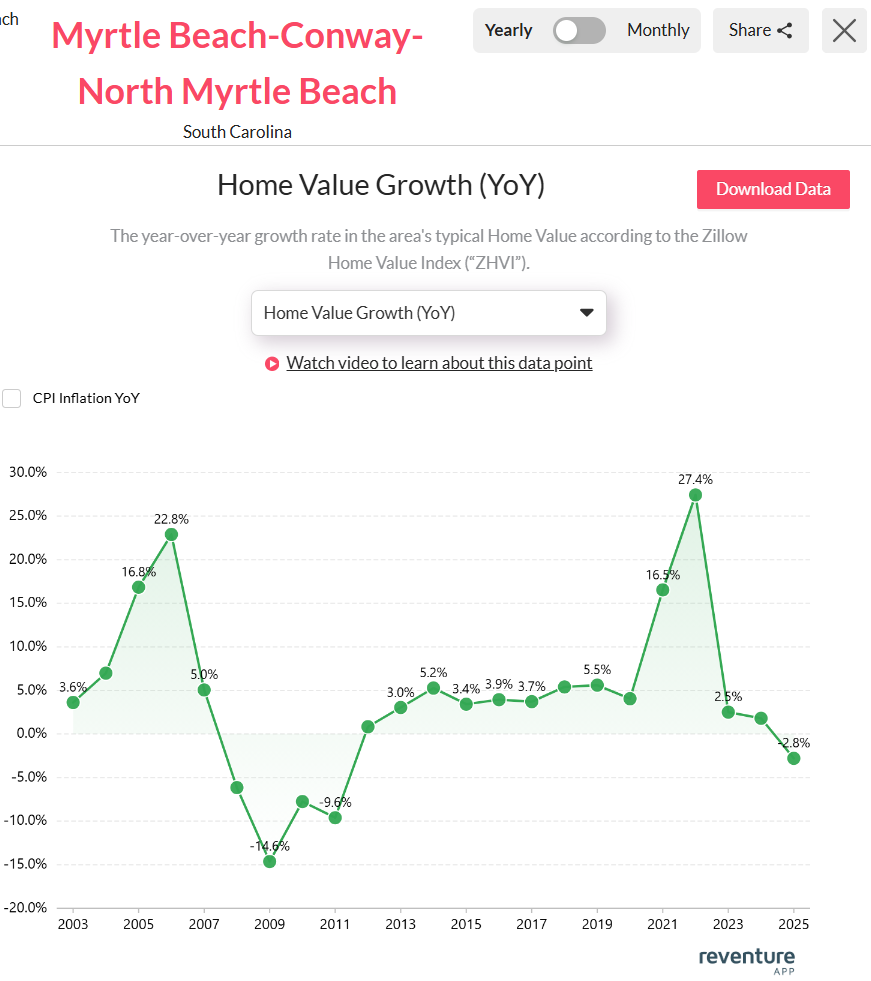

Home Value Growth YoY in Myrtle Beach, SC, Dropped to -2.8% in 2025

Myrtle Beach’s housing market has taken a noticeable turn in 2025, with the year-over-year (YoY) home value growth rate falling to -2.8%. This marks a sharp decline from the booming post-pandemic highs of the previous years.

Myrtle Beach, SC’s home value growth dropped to -2.8% in 2025. Access the home value YoY growth graph of the metro here. [Link]

According to data available on Reventure App, Myrtle Beach reached a peak growth of 27.4% in 2022, its highest since 2005. Even in 2023, the market held some momentum with a 2.5% increase. However, the continued economic tightening, rising interest rates, and affordability concerns appear to have pushed the market into a decline by 2025.

This downturn echoes a broader trend of cooling in high-growth metro areas, especially those that saw intense demand during the pandemic. Despite previous years of strong appreciation, the current negative growth suggests a market correction or stabilization phase.

Whether this dip continues or levels out depends on macroeconomic conditions, local demand, and inventory dynamics throughout the rest of the year.

Housing Market Trends in the Counties of Myrtle Beach, SC, in 2025

In 2025, the housing market in Horry County, home to Myrtle Beach, has shifted toward a more buyer-friendly environment. According to data available on Reventure App, home values in the county have declined by -3.6% year-over-year, a deeper drop than the metro’s overall -2.8% decline.

Horry County has the highest sales inventory (5,965) in the Myrtle Beach, SC, metro area. Access the above map here. [Link]

This decline is accompanied by an increase in for-sale inventory, with 5,965 active listings, suggesting that supply is outpacing demand. Homes are sitting on the market for an average of 75 days, indicating slower transaction turnover and reduced buyer urgency.

One of the more telling indicators is that 28.4% of listings have experienced price cuts. This signals that sellers are adjusting expectations in response to market softening. However, despite the slowdown, Horry County remains only mildly overvalued by 3.5%, which may cushion the risk of further sharp corrections.

With a population of nearly 397,500, Horry County is a significant market in South Carolina. The current trends suggest that while the market is cooling, it may be entering a period of stabilization rather than freefall..

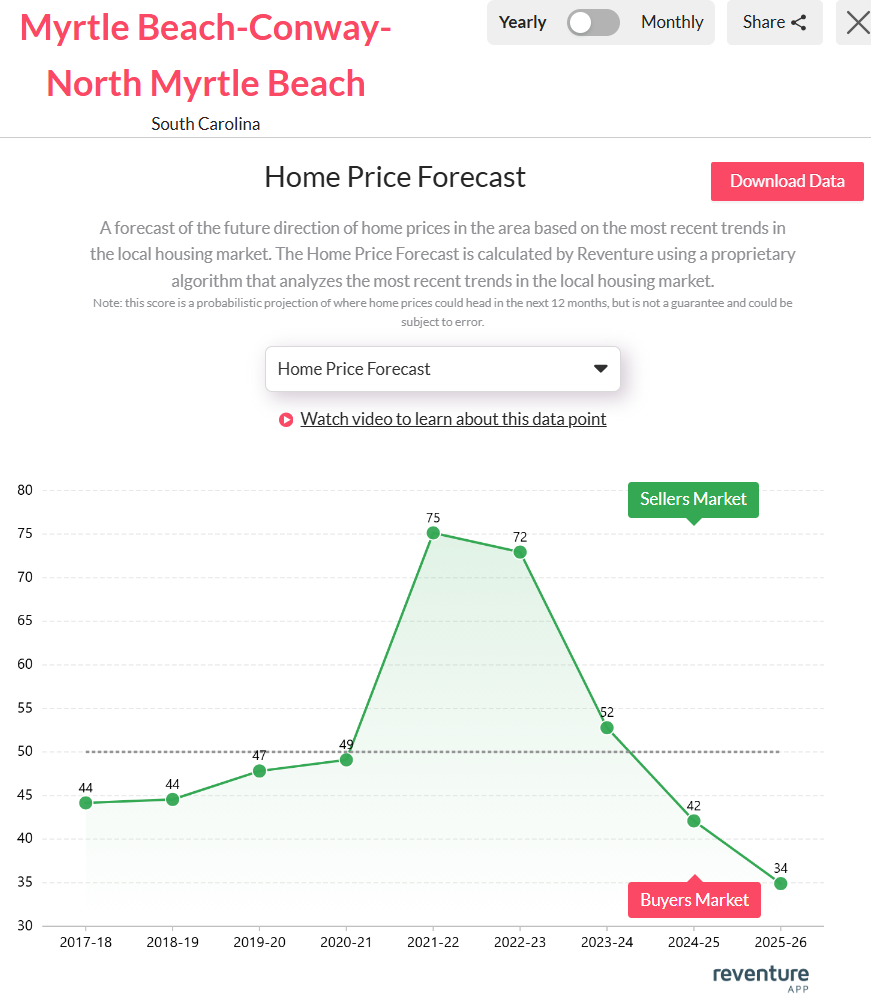

Myrtle Beach, SC’s Housing Market Predictions for 2025 – 2026

The Myrtle Beach, SC, housing market is expected to continue declining throughout 2025–2026. According to the Reventure App, the Home Price Forecast Score for the metro stands at just 34 out of 100, indicating that it is now a buyers’ market. On Reventure App, a score below 45 denotes a declining market, 45–55 suggests stability and scores above 55 reflect appreciation.

Myrtle Beach, SC’s Home price forecast score reached 34/ 100 in 2025. Access the home price forecast score chart here. [Link]

The steep drop from a peak score of 75 in 2021–22 to only 34 by 2025–26 highlights visible cooling in the market and highly reduced buyers’ demand. This downturn suggests more negotiating power for buyers, while sellers must price competitively and stay flexible to close deals. Both homeowners and investors should prepare for further weakening and reassess their strategies in this evolving market situation.

For buyers, sellers, and investors navigating Myrtle Beach’s shifting market, timing and insight are everything. With Reventure’s premium plan for just $39/month, you gain access to state, metro, county, and ZIP code–level forecasts on inventory, pricing, value trends, and market strength. Whether you’re planning to buy smart, sell competitively, or track future moves, Reventure delivers the local data edge you need to stay ahead.