Why Mortgage Rates have minimal impact Home Prices (1890-2025 data)

Every year, the housing market obsesses over the same question: where will mortgage rates go next? Buyers wait. Sellers hesitate. Investors build entire theses around a single number on the 30-year fixed. The assumption is always the same — that the direction of mortgage rates will determine the direction of home prices.

As we head into 2026, that belief is once again front and center. With the 30-year mortgage rate sitting at 6.29 percent in mid-December 2025, forecasts range from modest declines to aggressive calls for rates in the low fives. The implicit promise behind those predictions is clear: if rates fall far enough, home prices will rise again.

But that promise is false.

After analyzing 135 years of U.S. housing data, the conclusion is unavoidable. Mortgage rates do not determine where home prices go next. Not sometimes. Not on average. Not even weakly. Over more than a century of housing cycles, changes in mortgage rates explain none of the following year’s movement in home prices.

The housing market’s most popular causal story is also its most wrong.

Analyzing 135 Years of Housing Market Data, back to 1890

To determine whether mortgage rates—and, more importantly, changes in mortgage rates—actually influence home prices, I needed a dataset that extended well beyond modern housing cycles. Short-term comparisons are misleading. Only a long historical view can separate intuition from reality.

Fortunately, that data exists. Robert Shiller’s home price indices extend back to 1890 and are publicly available in downloadable format. Mortgage rate data comes from two sources: the Federal Reserve Bank of St. Louis, which provides series back to 1971, and the book Capital Formation on Residential Real Estate which contains mortgage rate estimates dating back to 1879. By combining these sources, I was able to construct a continuous dataset spanning roughly 135 years of U.S. housing history.

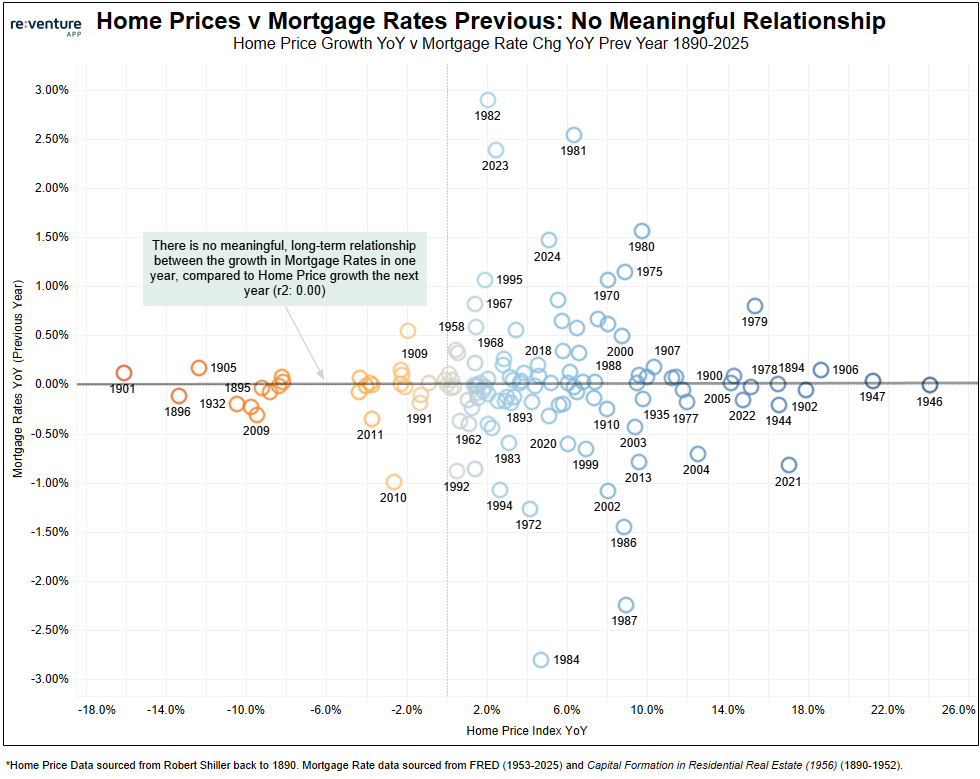

I then ran a series of regressions designed to test a simple and widely believed idea: whether changes in mortgage rates in one year have any measurable impact on home price growth in the following year. In other words, if mortgage rates rise or fall from one year to the next, does that change influence whether home prices go up or down the year after?

The result was not subtle. Over the full 135-year sample, there is absolutely no relationship between mortgage rate changes and subsequent home price growth. The R-squared is effectively zero.

This means that increases in mortgage rates provide no information about whether home prices will rise or fall in the following year. The widely held belief that higher mortgage rates lead to weaker home price growth simply does not hold up in the data. Just as importantly, the inverse belief—that lower mortgage rates lead to higher home prices—is also false.

Compared Mortgage Rates and Home Prices lagged as well

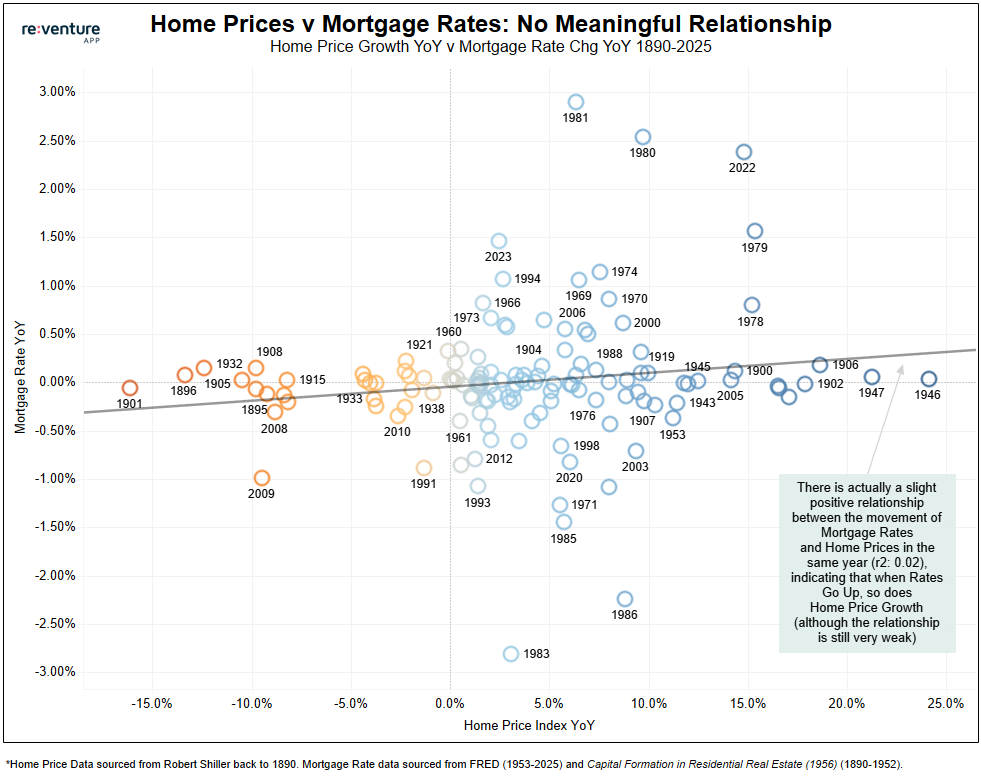

To ensure this result was not an artifact of timing, I also examined the relationship without a lag. This approach compares changes in mortgage rates and changes in home prices within the same year. Even then, the relationship remains extremely weak, with an R-squared of just 0.02. More surprisingly, the relationship is slightly positive, indicating that home price growth has tended to be marginally stronger during periods when mortgage rates were rising.

This counterintuitive result is largely explained by inflationary episodes in U.S. history, most notably the late 1970s and early 1980s, as well as 2022. During these periods, mortgage rates rose sharply as the Federal Reserve tightened policy. At the same time, home prices continued to accelerate due to elevated inflation and strong nominal income growth. Rising rates failed to suppress prices because they were reacting to inflation rather than causing it.

Viewed another way, the conclusion is unchanged no matter how the data is sliced. Whether mortgage rate changes are measured with a lag or examined contemporaneously, mortgage rates do not meaningfully impact home price growth.

That conclusion runs directly against one of the most deeply ingrained assumptions in housing market analysis. Yet across more than a century of data, the evidence is unequivocal.

If Not Mortgage Rates, Then What Does Impact Home Prices?

For many people in the housing market, these findings are jarring. The dominant narrative has long been that mortgage rates are the housing market—that home prices are little more than a mechanical output of interest rates and Federal Reserve policy. If mortgage rates rise, prices must fall. If mortgage rates fall, prices must rise.

That assumption is wrong.

If the direction of mortgage rates has no meaningful power in predicting future home price movements, the obvious question becomes unavoidable. What actually determines home prices?

The full answer deserves a deeper treatment, and it will be the focus of future analysis. However, our work at Reventure consistently shows that a very different set of variables drives home price growth. When we test a wide range of housing and macroeconomic indicators, the factors that matter most are months of supply, housing starts growth, home values relative to income, inflation, and rent growth. Most of these variables influence home prices with a lag, while inflation and rent growth tend to operate more contemporaneously. Mortgage rates are not on that list.

Months of Supply, Inflation, and the other Metrics that Matter

Among these drivers, months of supply stands out as the single most powerful predictor of future home price movements. That’s because months of supply provides a real-time read on the balance between supply and demand. How many homes are available for sale, relative to how many buyers are active in the market, tells you far more about where home prices are headed than the cost of financing those homes.

Prices follow inventory, not interest rates.

This leads to a more accurate framework for understanding the housing market. Home prices are shaped by two broad forces. The first is internal to the housing market itself: supply and demand. Inventory levels, construction activity, and household formation largely determine whether prices face upward or downward pressure. When supply is tight relative to demand, home prices tend to rise. When supply expands, price growth slows or reverses.

The second force is external: inflation. Housing does not exist in a vacuum. When the general price level across the economy rises, home prices typically rise faster in nominal terms. Conversely, when inflation cools or turns negative, that pressure eases and eventually feeds through to housing.

Inflation sets the nominal floor.

This is why periods of high inflation can coincide with rising mortgage rates and rising home prices at the same time—a dynamic that often confuses observers who assume rates are the causal driver. Taken together, home price growth is best understood as the interaction between supply-and-demand conditions and the inflationary environment. Mortgage rates reflect these forces, but they do not drive them.

Mortgage rates tell you how many homes will sell, not what they will be worth.

We’ll explore this framework in much greater depth in a future post.

Mortgage Rates Are Useful for One Thing: Predicting Home Sales

None of this means mortgage rates are irrelevant to the housing market. They just matter in a very different way than most people assume.

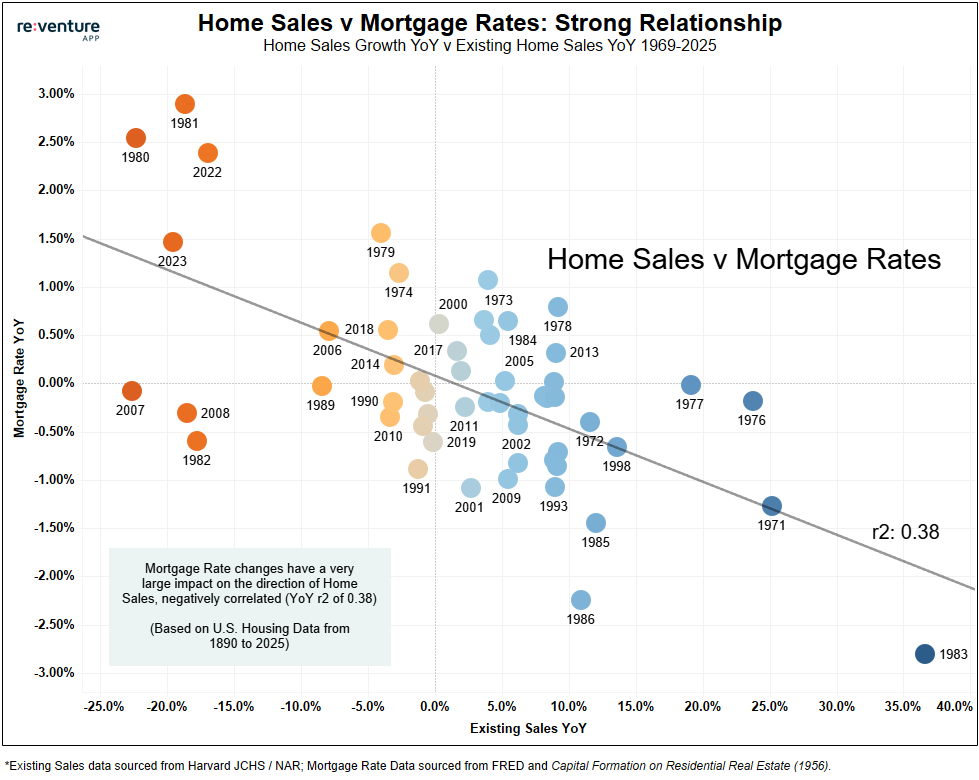

While mortgage rates have virtually no ability to predict future home price movements, they are highly effective at explaining changes in homebuyer demand and transaction volume. Using the same long-run mortgage rate dataset, combined with existing home sales data from the Harvard Joint Center for Housing Studies and the National Association of Realtors, a clear pattern emerges.

Changes in mortgage rates and changes in home sales move strongly together within the same year. The relationship is decisively negative: when mortgage rates rise, home sales fall; when mortgage rates decline, home sales increase. Over the past 56 years, the R-squared for this relationship is 0.38, which is remarkably strong for a single-variable regression in macroeconomic data.

This finding aligns with conventional wisdom, but only in the narrow context where that wisdom actually applies. Mortgage rates directly affect affordability at the monthly payment level, which influences buyer willingness and the ability to transact. Higher rates sideline marginal buyers and discourage move-up activity, while lower rates pull demand forward and increase turnover.

What mortgage rates do not do is determine the direction of home prices. Instead, they influence how many homes are sold, not what those homes ultimately sell for over time.

That distinction is critical. The housing market often experiences periods of low sales alongside stable or even rising prices, as well as periods of high sales paired with weak price growth. Mortgage rates help explain the former, not the latter.

Understanding this difference resolves much of the confusion in today’s housing debate. In practice, rates act as a demand throttle, not a price-setting mechanism.

Next Steps: Evaluating How Months of Supply and Inflation Impact Home Prices

In upcoming posts, I’ll take a closer look at the variables that actually drive home price movements, starting with months of supply and inflation. Both play a far more direct role in determining where prices are headed than mortgage rates, and both can be tracked in real time by homebuyers and investors who know where to look. Understanding these metrics is especially important as we move into 2026. Inventory dynamics and inflation trends will do far more to shape the next phase of the housing market than incremental changes in financing costs. Knowing how to interpret those signals can provide a meaningful edge, whether you’re buying, selling, or investing.

Much of this framework is already embedded in Reventure’s price forecasting models. Our forecasts are built from live market data such as inventory levels, days on market, and price cuts across nearly every ZIP code in the United States, allowing us to capture shifts in supply and demand as they happen rather than relying on lagged macro indicators.

We’re in the final stages of preparing our official 2026 U.S. housing market price forecast. If you want to see how these dynamics are shaping your local market, you can view the forecast for your area through Reventure Premium.