Miami Dade Housing Market Forecast for 2025

The Miami-Dade housing market in Florida is showing clear signs of a correction in 2025. After years of rising home values and tight supply, prices are beginning to fall while inventory climbs across the region. This shift marks a correction point for one of Florida’s major real estate markets. For buyers, the current conditions present a mix of opportunity and risk, more listings to choose from, but also the possibility of further price drops.

With market dynamics changing quickly, many are left wondering whether now is the right time to buy or if waiting could offer a better deal. This forecast explores the latest trends, data, and what they mean for anyone considering a move in Miami-Dade.

Miami Home Values Dip in 2025 After Pandemic-Era Surge

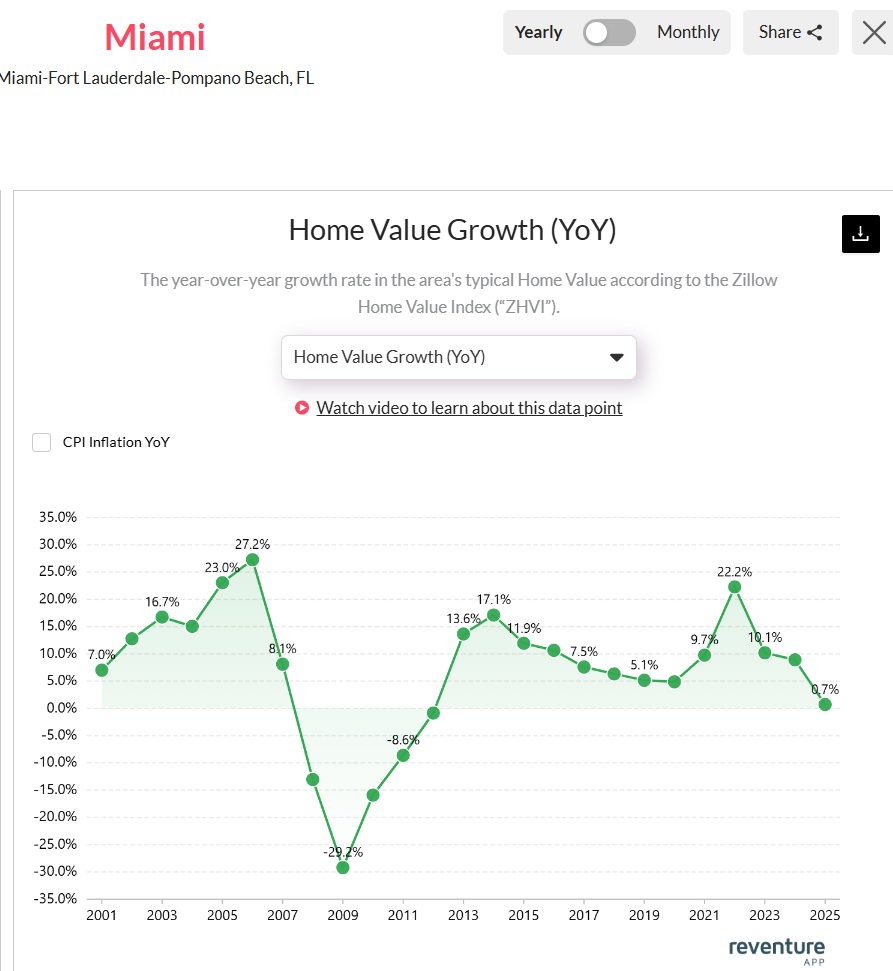

The Miami housing market has entered a cooling phase in 2025, with home values declining by 0.7% year-over-year, according to data available on Reventure App. This marks a significant shift from the double-digit growth seen in recent years and suggests the region is now undergoing a market correction.

Looking at historical trends, Miami has experienced sharp ups and downs over the past two decades. Home values surged 22.2% in 2022 and 10.1% in 2023, largely driven by the pandemic-era housing boom, fueled by low interest rates and heightened demand from out-of-state buyers.

Miami home values fall 0.7% year-over-year in 2025, indicating a clear cooling trend after years of explosive growth. Access the above graph here. [Link]

However, the chart also shows that Miami has not been immune to downturns. During the 2008 housing crash, values plummeted by -20.2%, followed by several years of recovery. The current dip is far less severe but raises concerns about the sustainability of the post-pandemic spike.

This slowdown in price growth, paired with rising inventory, indicates that buyer demand is weakening. Whether this is a temporary pause or the beginning of a longer correction will depend on broader economic conditions, interest rates, and affordability in the months ahead.

Miami Inventory Rebounds Sharply, Hitting 5-Year High in 2025

Miami’s housing inventory is climbing fast, reaching 19,319 active listings in April 2025, the highest level recorded since 2019. After hitting a pandemic low of just 6,376 listings in 2022, the market has more than tripled its available supply in just three years.

This sharp increase in inventory is a major shift from the supply shortages that defined the COVID housing boom. Between 2020 and 2022, limited listings and high demand sent prices soaring. But now, as buyer interest cools and more homes return to the market, supply is finally catching up, if not outpacing demand.

Miami’s housing supply hits a 5-year high with 19,319 active listings, tripling since the 2022 low. Access the above graph here. [Link]

When inventory rises this rapidly, it usually highlights a change in market dynamics. Sellers have more competition, and buyers have more choices. That typically leads to slower price growth—or even price declines, as we’re starting to see in 2025.

With inventory now at its highest level in over five years, the trend points to continued downward pressure on prices. If supply continues to increase without a proportional rise in demand, Miami’s housing correction may deepen further in the coming months.

For buyers, the growing inventory means more options. For sellers, it indicates a tougher market ahead.

Best and Worst Neighborhoods to Buy in Miami-Dade in 2025

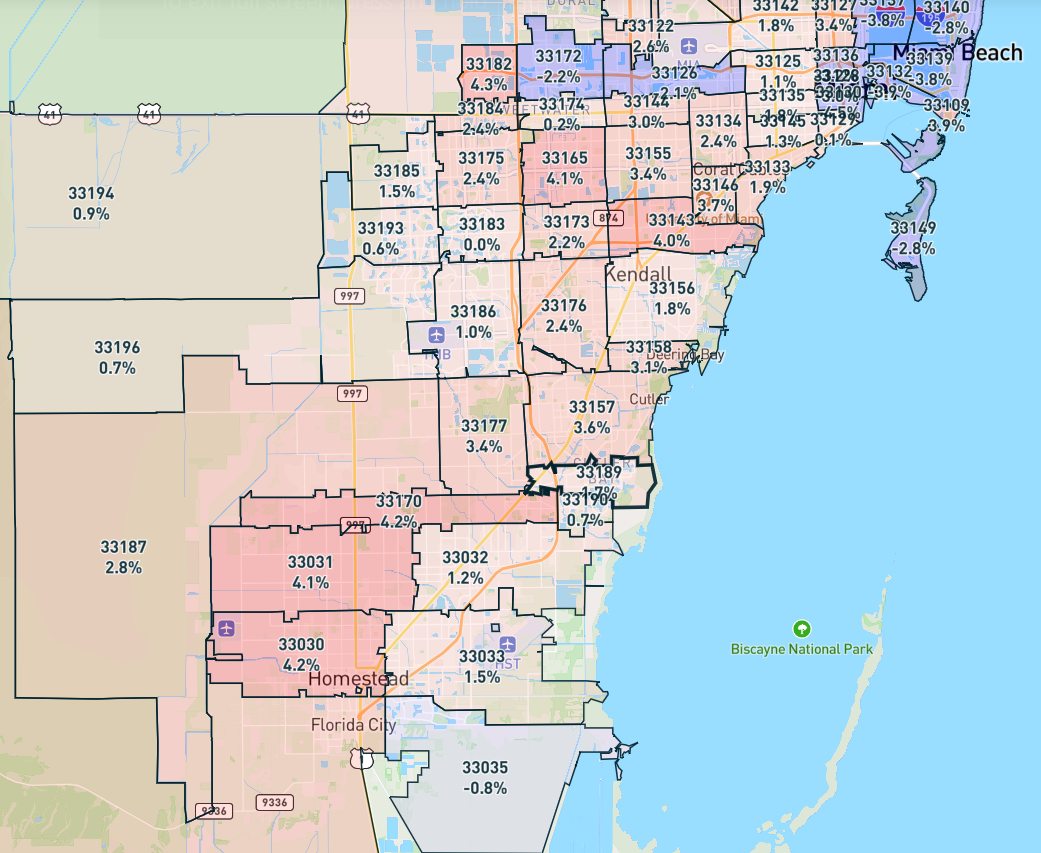

As Miami-Dade’s housing market corrects, some ZIP codes are seeing sharp price declines, potentially offering good opportunities for buyers looking for deals.

Leading the pack in price drops is 33141 (Miami Beach), where home values are down -5.9% year-over-year and nearly 1 in 5 homes have had a price cut. Also in decline are central Miami ZIPs like 33131 (-4.6%), 33130 (-4.5%), and 33132 (-3.9%), all with significant overvaluation percentages and weakening demand.

Neighborhoods like 33137 (Miami) and 33139 (Miami Beach) are also cooling, with YoY price drops around -3.8% and price cuts hovering above 15%.

Home value growth year-over-year trends vary widely across Miami-Dade ZIP codes, with cooling blue zones and still-heated red pockets. Access the above map here. [Link]

On the other hand, some ZIP codes are still seeing rising prices, but they come with risks. For example, 33146 (Miami) and 33127 (Miami) are up 3.7% and 3.4%, respectively, yet they are also among the most overvalued areas, both showing over 75% overvaluation.

Buyers should exercise caution in rising areas with inflated value-to-income ratios, while the softening neighborhoods may offer better long-term entry points as the correction plays out. Localized research is key to making the right move in this uneven market.

Now the question is, should you buy today or wait? The answer lies in the data, specifically, Reventure App’s Home Price Forecast Score. Available exclusively through the Premium Plan, this score (ranked from 0 to 100) shows you the likelihood of home prices rising or falling over the next 12 months. A score closer to 0 indicates a high risk of further price drops.

Moreover, for just $39/month, you can unlock this powerful tool and see the exact forecast for your specific ZIP code. Paired with our Home Price Conversion Chart, it could help you time the market and save thousands on your next home.