Los Angeles Housing Market Update – June 2025

The Los Angeles housing market is shifting gears as inventory climbs and price cuts become more widespread heading into summer 2025. After years of tight supply and overheated bidding wars, new listings are steadily outpacing demand, giving buyers more choices and breathing room.

Recent data shows that homes are spending more time on the market, and sellers are increasingly adjusting their asking prices to attract offers. This marks a notable change from the fast-paced market of previous years, indicating a potential cooldown. In this update, we break down the housing market situation in Los Angeles as of June 2025 and what to expect next.

Inventory on the Rise in Los Angeles in 2025

Los Angeles County’s housing inventory is surging in 2025, offering the clearest sign yet that the market is cooling. According to data from Reventure, there were 13,695 active listings in May 2025, a sharp increase from 9,338 in 2024 and more than double the 6,946 listings recorded in 2023. This marks the highest level of inventory since the 2019 peak of 14,056.

Los Angeles housing inventory surged to 13,695 listings in May 2025, the highest level since 2019. Access the above graph here. [Link]

The pace of growth is even more striking. Year-over-year inventory growth reached 47.1% in May 2025, following a 34.0% jump in 2024. These back-to-back spikes come after several years of contraction and stagnation, highlighting a major shift in market dynamics.

The influx of listings means buyers now have more choices, and homes are no longer moving as quickly. This is putting pressure on sellers to lower prices or make concessions.

Moreover, if inventory growth continues at this rate, Los Angeles may soon face downward pressure on prices, especially in neighborhoods that saw aggressive appreciation during the pandemic boom. For buyers, this could be the opening they’ve been waiting for.

LA Price Cuts Hit an 8-Year High in 2025

Alongside rising inventory, price reductions are becoming far more common across Los Angeles County. In May 2025, 20.1% of all active listings had a price cut, the highest percentage recorded since at least 2017. That translates to 3,868 homes with reduced asking prices out of a total inventory of 19,221.

20.1% of listings in LA saw price reductions in May 2025, the highest rate in over 8 years. Access the above graph here. [Link]

This sharp increase in price cuts suggests that many sellers are struggling to attract buyers at initial listing prices. By comparison, just a year earlier in May 2024, only 15.3% of listings saw reductions. The jump of nearly 5 percentage points in one year underscores how quickly the market is softening.

Historically, price cut levels have fluctuated between 13% and 19%, but 2021 was an outlier at just 7.3%, when red-hot demand drove bidding wars and over-asking offers. The reversal in 2025 is clear evidence of a cooler, more price-sensitive market.

If this trend continues, home values could start declining, especially in areas where speculative buying drove prices too high. For buyers, this shift opens opportunities to negotiate more favorable deals, especially on properties that have lingered on the market.

Home Value Growth Slows Sharply in 2025

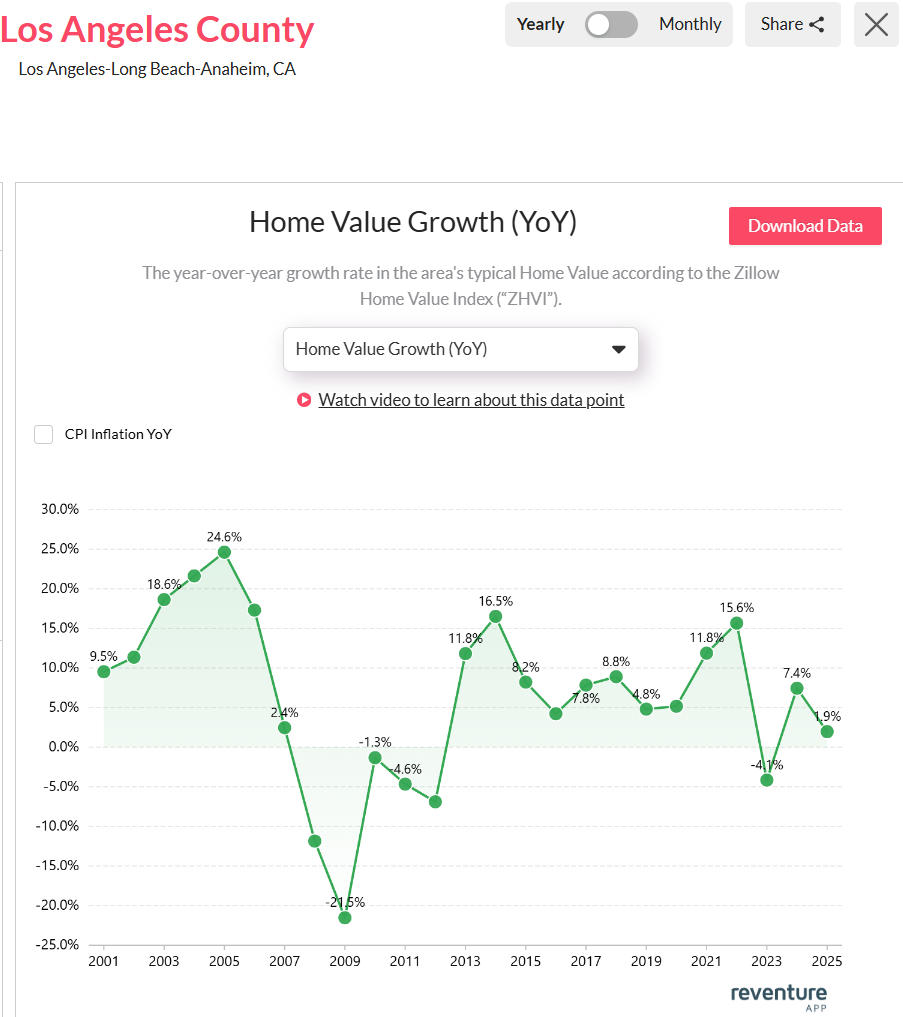

As inventory surges and price cuts climb, home value growth in Los Angeles is beginning to lose momentum. In May 2025, home value growth reached just 1.9% year-over-year, down significantly from the 7.4% growth recorded in 2024 and a far cry from the double-digit appreciation seen in 2021 and 2022.

This sharp slowdown suggests the market is shifting from rapid gains to stabilization, or even a possible decline shortly. Compared to the peak 15.6% growth rate in 2022, the current pace reflects a much cooler environment.

Home value growth in Los Angeles slowed to just 1.9% in 2025, signaling a sharp market cooldown. Access the above graph here. [Link]

A 1.9% increase is barely above inflation, meaning real price gains are nearly flat. For sellers who bought recently at higher prices, this may limit profit potential. But for buyers, especially first-timers, it could indicate improved affordability ahead.

With pressure mounting from rising inventory and seller discounts, the Los Angeles market may be entering a prolonged adjustment phase. Slowing home value growth suggests that the red-hot post-pandemic market is cooling, and price declines could soon follow in certain neighborhoods.

For buyers and sellers trying to make sense of LA’s shifting market situation, timing is everything. That’s where Reventure’s premium plan can help. For just $39 per month, you can access detailed, ZIP code–level home price forecasts powered by real-time market data. Whether you’re looking to buy smart, sell strategically, or simply monitor trends, Reventure gives you the tools to stay one step ahead.

Access Housing Market data for California and All Other U.S. States on Reventure App.

One Response