Is the U.S. Housing Market officially in a Recession?

America is officially in a housing recession — at least according to a top Trump Administration official.

Scott Bessent, the U.S. Treasury Secretary, recently dropped a bombshell during a televised interview, declaring that the U.S. housing market is in a “recession” in late 2025. He attributed the downturn to the Federal Reserve’s persistently high interest rates, which have kept borrowing costs elevated even after six rate cuts this year.

This admission marks one of the first times a senior government official has acknowledged what many data analysts — including Reventure — have been warning about for months: the housing market is slowing sharply. The question is: will this housing market recession turn into a crash, and if so, how much cheaper will prices become for buyers in 2026?

Scott Bessent’s surprising “Recession” call

In a recent interview with CNN’s Jake Tapper, Scott Bessent revealed that while he thinks the economy is in good shape overall, certain sectors are starting to show cracks – in particular, housing. According to Bessent, high interest rates have slowed the economy and housing market in particular.

What Bessent is referring to with the housing recession call is a perpetually low homebuyer demand environment, with existing home sales now trending at close to their lowest level in nearly 30 years. According to the NAR, September 2025’s existing home sales print of 4.06 million annualized was one of the lowest readings ever for the month of September, and down approximately 25% from pre-pandemic norms.

Search Home Sales Data for your ZIP Code Now

This data might come as a surprise to some homebuyers and real estate investors, as narrative in many local markets remains that “buyers are still coming in” and that “people are still moving in to buy up homes”. But in reality, this was the story 3-4 years ago, and is no the longer the story of today. As a result, Scott Bessent’s “recession” call on the housing market is a correct one. However, one big aspect of the market still hasn’t hit a notable recession, and that’s prices.

A Market Frozen by High Prices and High Rates

But here’s the confusing thing for buyers and investors alike: while home sales activity is near record-low sales, and clearly indicates a market in recession, home prices still remain near record highs. According to the same data set from the National Association of Realtors, the median sale price on the market was $415,200 in September 2025, up 2.1% from the previous year. These resilient prices, which are now over 40% higher than they were prior to the pandemic, are one of the central reasons why demand has remained low. Put simply: regular homebuyers cannot afford the current price points in today’s market, with a higher share of recent transactions being from high-income buyers in the luxury market.

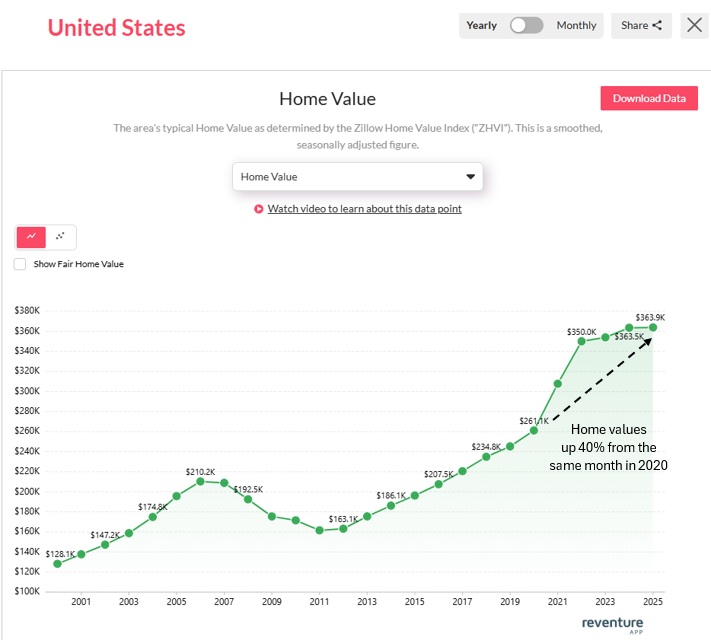

According the graph below, sourced from Reventure App, the typical home value in the U.S. is currently $363,000 (slightly lower than the NAR’s median sale price, due to the upward bias in the type of homes that are transaction in this market). You can see that this typical home value is up 40% from its level five years, when it was $261,000. Put clearly: there has been no home price crash, or even a correction yet, at the national level.

Search Home Value Data for your ZIP Code Now

This surprising resilience on prices isna primary contributor to the depressed demand environment that Secretary Bessent was referring to in his housing recession call. So long as prices stay this high, buyers will likely remain on the sidelines, and the recession will continue.

Will the Fed cut interest rates and cure the housing recession in 2026?

One point that Secretary Bessent made clear is that the Federal Reserve was to blame for the housing market’s and economies problems. In particular, Bessent noted that “I think that we are in good shape, but I think that there are sectors of the economy that are in recession”. From there, he clarified “So if the Fed brings down mortgage rates, then they can end this housing recession,” with the main implication being that elevated mortgage rates are the cause of the depressed sales activity in the market.

But is this really true? Will the Fed cutting interest rates “cure” the housing recession and lead to more homebuyer demand? We can see that today’s 30-year fixed mortgage rate rests around 6.3% according to Mortgage News Daily, which is down from approximately 7% one year ago. However, this mortgage rate is still nearly double its level of the 2020-21, when rates were around 3%, and they are still well above pre-pandemic trends.

But thus far, homebuyer demand has not been receptive to Fed Interest Rate cuts. Since September 2024, the Fed has cut interest rates 6 times, and homebuyer demand continues to drop, with Redfin reporting that 2025 is set for the lowest homeowner turnover rate on record. This implies that more Fed rate cuts might not re-stimulate demand, with the real underlying issues being prices.

Will U.S. Home Prices crash in 2026? How Overvalued are Home Prices in your ZIP Code?

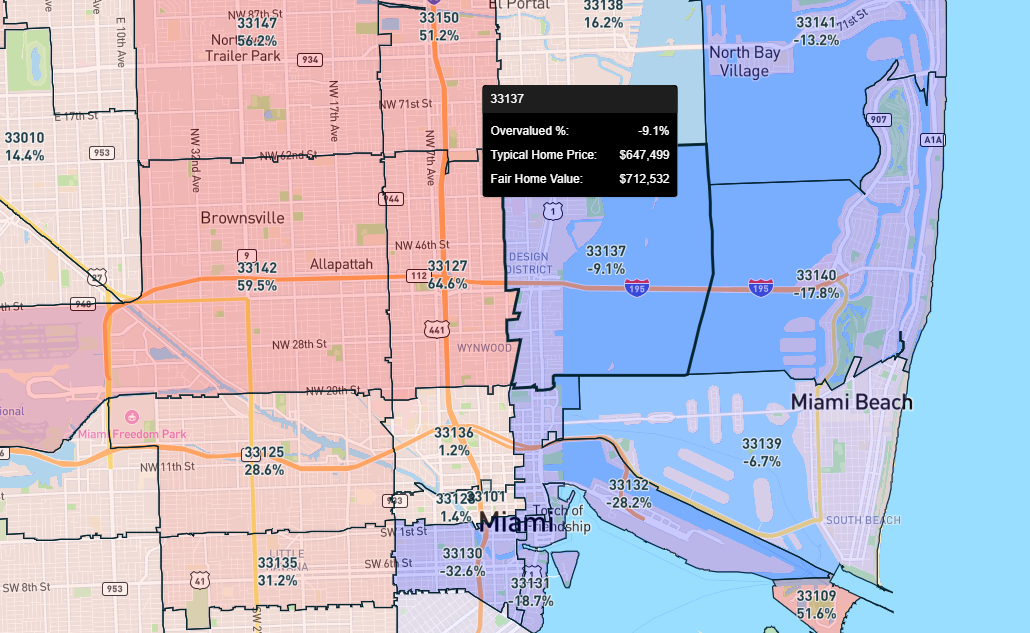

But will the market finally crash in 2026? Reventure’s data suggests a continued slowing in the market, with home values estimated to drop -0.3% over the next 12 months on a national basis. How much home prices drop will depend on the trends in inventory and price cuts in your market, as well as how overvalued prices are from long-term norms. Data from Reventure App allows homebuyers, investors, and realtors to answer the question of whether it’s a good idea to buy entering 2026, and which markets buyers can find the best bargains in. Upgrade to a Reventure Premium subscription today to access our Overvaluation % data by ZIP code, going back 20+ years, giving you confidence in identifying the areas to avoid and the areas to buy.

Overvalued markets are in red on the Reventure Map, with a positive overvaluation figure (e.g., +28.6% overvalued). Undervalued markets are in blue, and have a negative figure (e.g., -9.1% undervalued). We track this valuation data going back 20+ years, using inputs from Zillow’s home value index and US Census Bureau incomes. Real estate investors and homebuyers who want to avoid the housing recession in 2026, and buy in the best ways, should upgrade now to find the most undervalued markets.