Highest Cap Rate Markets in America – August 2024

Real estate investors are concerned with two principal things: 1) rental cash flow and 2) appreciation. Maximizing both of these elements is paramount to having a successful real estate investment strategy, especially in today’s uncertain market entering late 2024.

Due to today’s higher interest rate and price environment, maximizing rental cash flow has become more difficult for investors. It’s difficult to find good deals and even when you do, the returns are skinny.

As a result – investors might want to turn their attention to higher cap rate market in the second half of 2024. These areas have a decently sized population of at least 500,000, mixed with cap rates north of 7.0%. Investors can actually buy in these markets today and cash flow from day one.

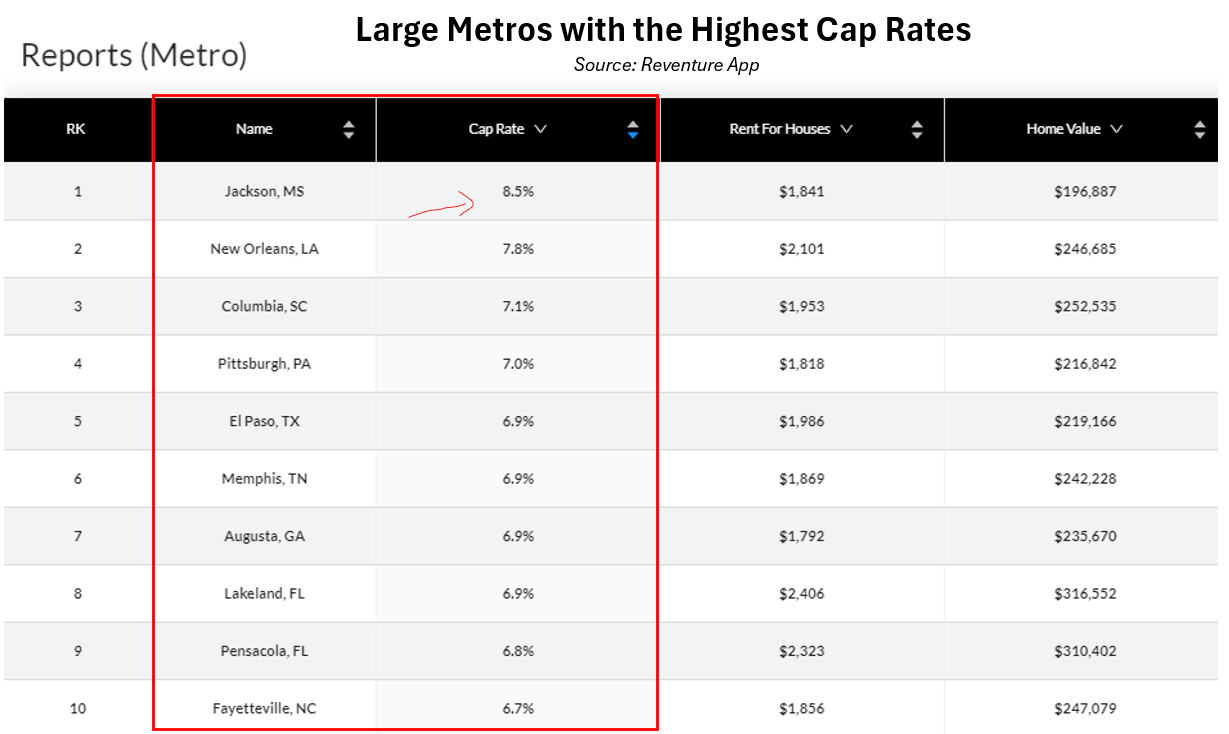

Top 10 Cap Rate Markets across America – August 2024

Reventure App has cap rate data for every State, most metros, and many ZIP codes across America. The cap rate is the unlevered return a real estate investor can expect to receive when they buy a property and rent it out. Put simply – it’s the net rental income divided by the purchase price. If home prices are lower in a market, generally the cap rates will be higher, and vice versa.

You can see on the table below the Top 10 Markets in America with the highest cap rates in 2024, with a minimum population size of 500,000. Jackson, MS tops the list with an 8.5% cap rate, indicating that investors can buy the typical rental property and lease it out for an 8.5% return net of expenses. Another market with a high cap rate is New Orleans, where investors can receive a 7.8% return unlevered from day one. Other markets with high cap rates include Columbia, SC, Pittsburgh, El Paso, and Memphis.

Of course – just because these markets have high cap rates doesn’t mean they don’t have flaws. Higher cap rate markets tend to be located in areas where home price appreciation has been lower in recent years (thus the ability to buy houses at cheaper prices). Moreover – higher cap rate markets could also struggle with societal issues like high poverty rates.

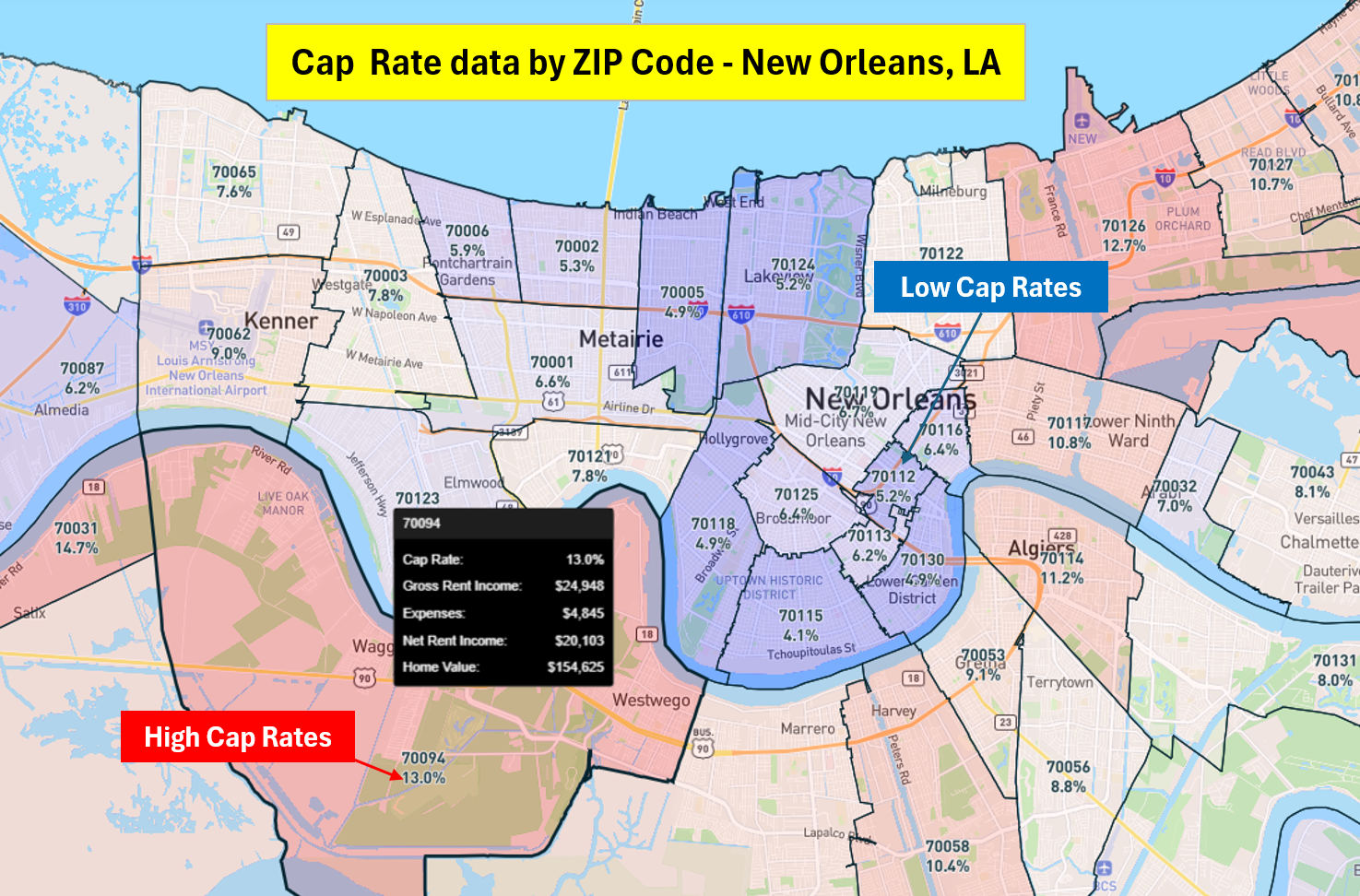

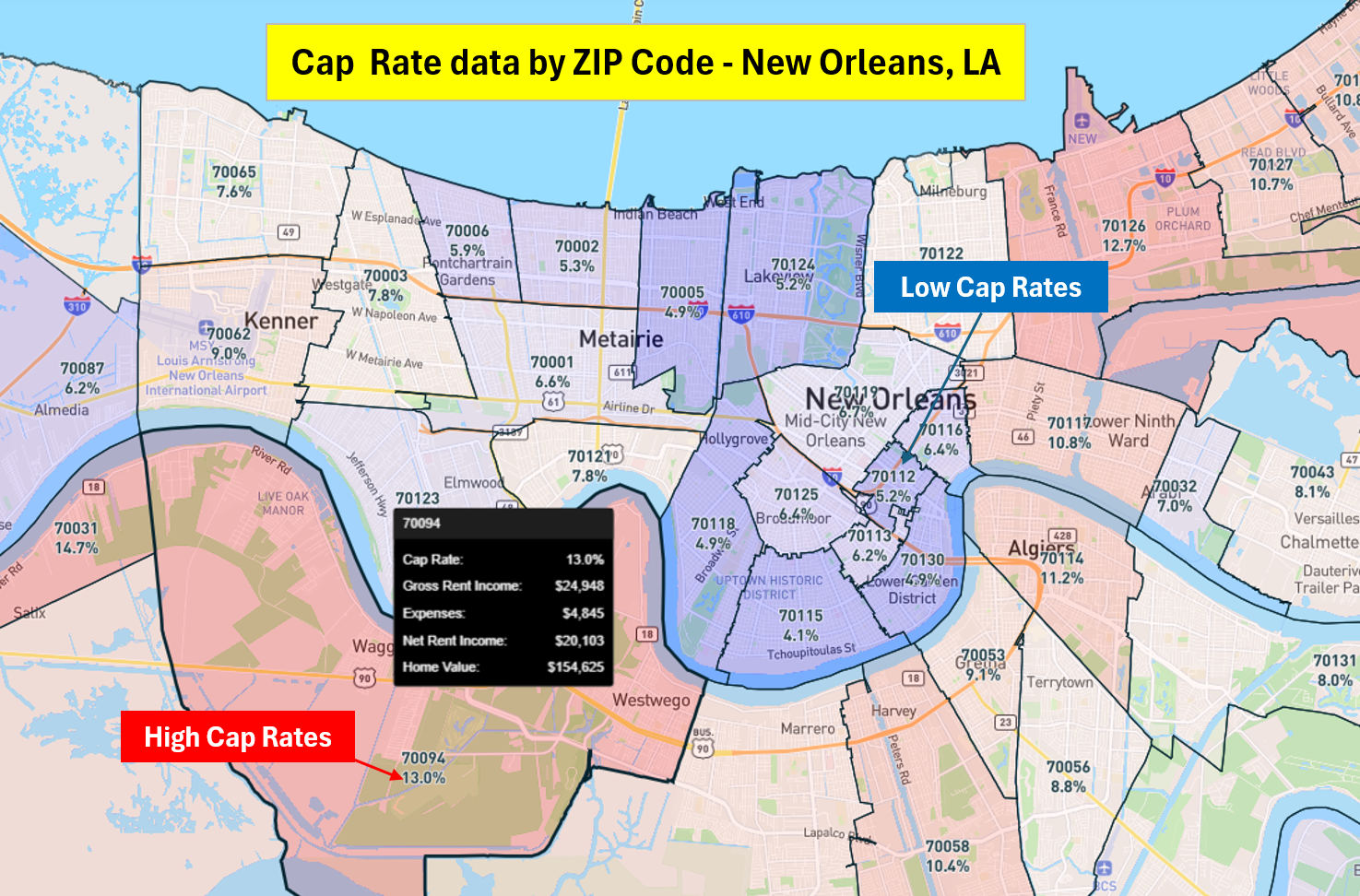

Cap Rates vary significantly by neighborhood and ZIP Code

But perhaps the most important thing a real estate investor needs to understand is neighborhood and micro-location. It’s one thing to decide upon investing in a metro-area due to it’s high returns and cap rates. But it’s another task entirely to decide on the right neighborhood to buy real estate within that metro.

The way I think about this decision making process is: select the metro that generally meets your criteria for what you want in a real estate investment (whether it be affordability, return, growth, stability, job industry, etc.). From there – find the neighborhoods within that metro that best maximize those criteria even further.

In the case of New Orleans – you can see that the Cap Rate an investor can earn varies significantly by neighborhood. In the center of New Orleans, closer to Bourbon Street and where all the tourism is, the Cap Rates are low – ranging from 4-5%. This is due to higher price points in these areas. Comparatively, if you head down south of the river, or east of the downtown, you can see neighborhoods with much higher cap rates – on the order of 10-12%.

Once again – just because a neighborhood has a higher cap rate doesn’t mean it’s necessarily a great place to invest. In the case of 70094 – you can see that the Cap Rate is 13.0% based on net rental income for a house of $20,000 divided by the typical home value of $154,000. So if you spend $154,000 on a house, you can get $20,000/year in cash flow (before mortgage interest). That’s a pretty good return.

However – this type of neighborhood could have some downside from a real estate investment standpoint. For starters, it’s 5-year home price growth is -1.6%, meaning it has lost value of the last five years while most other places in America have appreciated. This area also got hit very hard in the last housing crash from 2007-12, declining by -29% when the rest of New Orleans performed much better. So there could be more price volatility in a housing downturn.

When it comes to Cash Flow – it’s about balancing Risk v Reward

High cap rate and cash flow markets/neighborhoods provide the reward of allowing investors to make money from day one. And by providing returns that beat treasury yields and put money in investors pockets. However, there are risks associated with this. High cap rate markets tend to be located in higher poverty neighborhoods that have more historical price volatility. And recent appreciation levels could be low.

It’s imperative for real estate investors to understand and access this Cap Rate data before making a decision on where and when to buy real estate. Head to www.reventure.app to access Cap Rate data for city and ZIP code under a premium plan (the cost if $39/month).

-Nick