Florida Housing Market Flip: Why Miami and Tampa Are Finally a Buyer’s Market

Florida’s red-hot housing boom has finally cooled. The years of bidding wars and record-breaking prices are over. And Miami and Tampa are now tilting in favor of buyers. Realtor.com data shows both metros sitting above the six-month supply mark. It is the key threshold that indicates a buyer’s market.

Moreover, homes are staying on the market longer, and more sellers are cutting prices to attract offers. But this isn’t a crash; it’s a correction. Inventory surged by over 100% across Florida since the pandemic peak. And it is giving buyers a rare benefit.

With affordability stretched and listings piling up, the Sunshine State’s housing power dynamic has flipped. Let’s figure out more about it:

Days on Market: Miami Slows Down, Tampa Moves Faster

Homes in Miami are sitting on the market for an average of 89 days, while Tampa’s listings move faster at 79 days. This ten-day gap may seem small, but it highlights a key market contrast.

Miami’s luxury-heavy inventory tends to linger longer, as high-end buyers negotiate more aggressively. Tampa’s mid-range housing, by contrast, attracts faster turnover, especially from local families and first-time buyers.

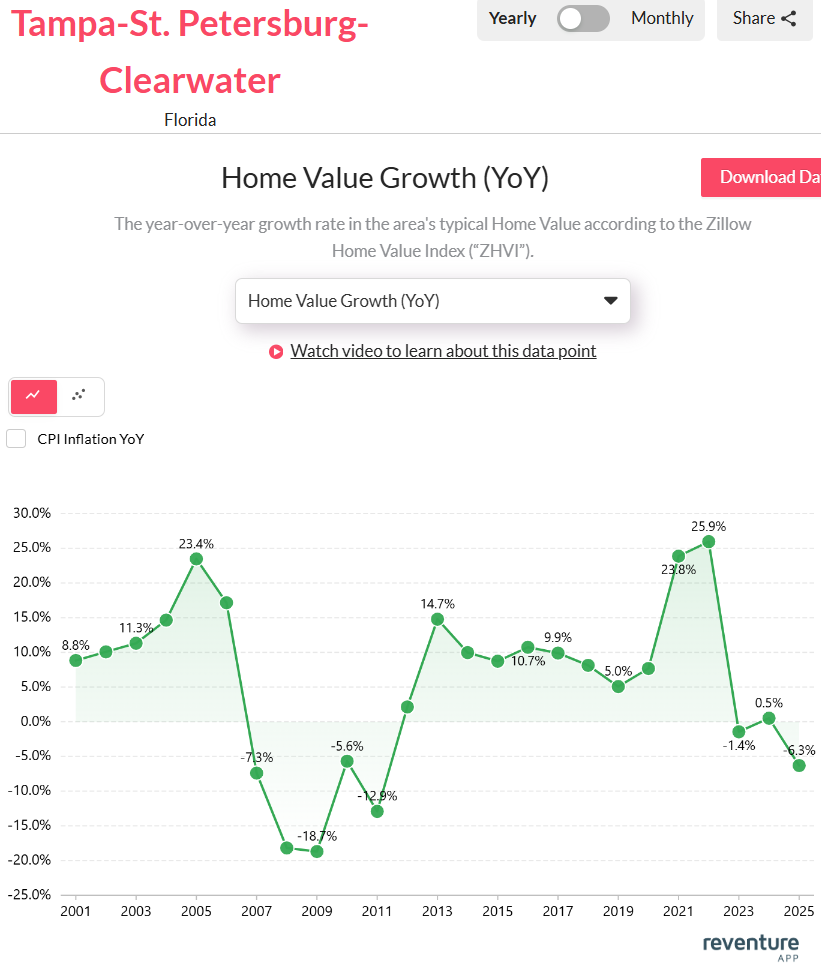

Home Value Growth: Price Drops Hit Tampa Harder

Price trends tell an equally revealing story. Miami’s home values fell 4.6% year-over-year, while Tampa saw a steeper 6.3% decline. That sharper drop reflects a more pronounced correction in Tampa’s once-surging suburban markets.

Tampa’s home values have flipped sharply from pandemic highs, falling 6.3% in 2025. Access the above graph here. [Link]

Tampa’s decline follows two years of rapid appreciation that pushed affordability out of reach. As rates rose and insurance costs spiked, the correction was inevitable. Miami’s smaller dip suggests that international demand and high-net-worth buyers are cushioning price erosion.

Still, both markets are cooling. It is a stark reversal from the pandemic-era boom that saw double-digit annual gains. The correction phase indicates a return to balance rather than a collapse.

For-Sale Inventory: Miami Flooded with Listings

Miami currently holds 47,033 homes for sale, more than double Tampa’s 18,674. This massive inventory gap explains much of the difference in pricing behavior and time on market.

Miami’s high supply has pushed it deep into buyer’s market territory. Luxury condos, new coastal builds, and investment properties crowd the listings, giving buyers more options and bargaining power. Tampa’s smaller, but still elevated, inventory suggests a market that’s cooling but not oversaturated.

Miami’s inventory surge reflects speculative overbuilding, while Tampa’s reflects normalizing demand. Both, however, mark a clear break from Florida’s low-inventory, high-competition years.

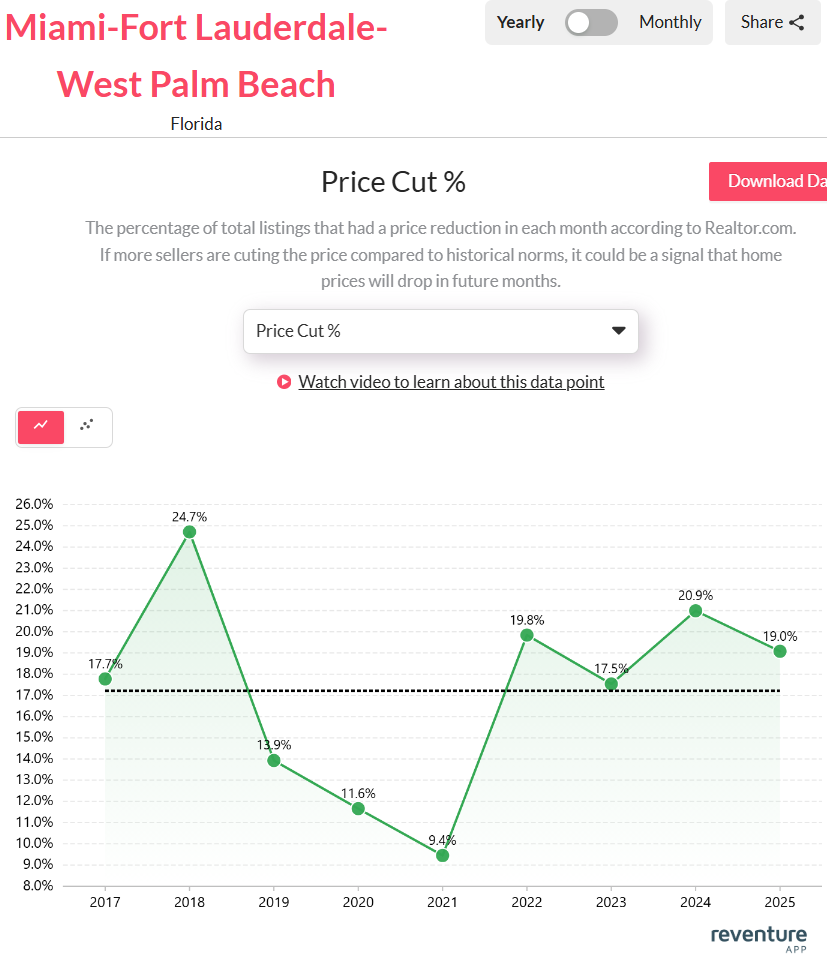

Price Cuts: Tampa Leads the Discounts

When it comes to seller flexibility, Tampa stands out. Nearly 32.4% of listings have seen price reductions, compared with 19% in Miami. That’s a clear indication that Tampa’s sellers are adjusting faster to market realities.

Miami’s price cuts remain elevated at 19% in 2025, showing sellers are trimming expectations after years of rapid growth. Access the above graph here. [Link]

Miami’s sellers, buoyed by wealthier buyers and cash deals, are holding the line longer. But the growing share of discounted listings statewide suggests sellers across both metros are learning that the era of over-asking offers is over.

For buyers, this is where opportunity lies. Tampa offers deeper discounts, while Miami offers greater variety. Both now reward patience and negotiation.

Value-to-Income Ratio: Miami Remains Costly

Affordability remains a critical divide. Miami’s value-to-income ratio of 5.7 means median home prices are nearly six times higher than typical household incomes. Tampa’s ratio of 4.5, while still high, offers comparatively better access for middle-income buyers.

This disparity explains much of the migration between the two metros. Many residents priced out of South Florida’s coastal counties have moved to Tampa Bay or inland areas where homes remain within reach. As a result, Tampa’s affordability advantage has fueled population inflows even during the slowdown.

Final Thoughts

This affordability divide perfectly sums up Florida’s market flip. Miami, weighed down by luxury listings and steep price-to-income ratios, remains a playground for wealthy buyers. Tampa, on the other hand, has emerged as the state’s true buyer’s market. It is more accessible, price-flexible, and still drawing steady migration.

If you want to see your state, metro, or county’s housing situation, buy Reventure Premium. For just $49 a month, you can access 40+ data points, from mortgage-to-income ratios to home values and inventory growth. And it offers 6x more accurate forecasts than Zillow. Because in a market that’s holding tighter than ever, precision isn’t a luxury.

Upgrade to Reventure Premium