The End of 3% Mortgages: Why the Mortgage Lock-In Effect Is Fading in 2026

Will home prices drop in 2026, or will they go up? The answer to that question depends on factors related to mortgage rates, rents, and the fading of the mortgage-rate lock-in effect. In this article, Reventure will analyze why we could be exiting the era of 3% mortgage and how this could lower home prices in 2026, especially in markets with weakening rents.

Over the last three years, the housing market has been defined by one phenomenon: the Mortgage Rate Lock-In Effect. Millions of American homeowners secured ultra-low mortgage rates during 2020–2021. When rates surged that dynamic discouraged mobility, froze existing-home inventory, and helped prop up prices despite deteriorating affordability. But new data suggests that this lock-in effect — long the primary force supporting home valuations — is beginning to weaken.

And as it fades, the market setup in 2026 looks very different from what buyers and sellers have grown accustomed to.

Fewer 3% Mortgages: Why the Lock-In Effect is Finally Weakening

From mid-2022 through 2024, the housing market operated under conditions never seen before. Mortgage rates doubled. Affordability collapsed. Yet home prices remained unusually sticky because very few owners were willing to trade a 3% mortgage for a 7% one. Academic estimates show the lock-in effect reduced nationwide home sales by more than a million transactions and boosted home prices by roughly 5–6% above where they otherwise would have been.

During the peak of ultra-low rates, 24.6% of mortgage holders in the U.S. had a rate below 3%. Only 7.3% had a mortgage above 6%. This meant that tens of millions of existing homeowners were sitting on monthly payments far cheaper than prevailing rents or the cost of buying a new home in 2022 and 2023. The incentive to stay put was enormous, and new listings collapsed as a result.

2026 is the Year When the Mortgage Rate Lock-in Flips

But that calculus is beginning to change. Several years of higher interest rates have reshaped the mortgage-rate distribution. As of 2024–2025, the share of mortgage holders below 3% is now roughly equal to the share above 6%. And by early 2026, more mortgage holders will likely carry a rate above 6% than below 3%.

This shift matters because it means the “payment advantage” of staying locked in is weakening. As more households hold mortgages at today’s higher rates — whether because they purchased recently, refinanced late, or moved despite rate conditions — the average cost of ownership is rising across the homeowner population. Over time, this erodes the psychological and financial barrier that kept millions of owners from listing their homes.

We are already seeing the early effects. In many markets, inventory levels began rising in 2024 and continued through 2025. More owners are choosing — or being forced — to list. Financial pressures, life-cycle changes, and a narrowing rate advantage are all contributing to the erosion of the lock-in effect.

This marks the first meaningful loosening of supply constraints since the pandemic boom — and sets the stage for higher inventory levels in 2026.

Inventory Tailwinds Are Forming for 2026

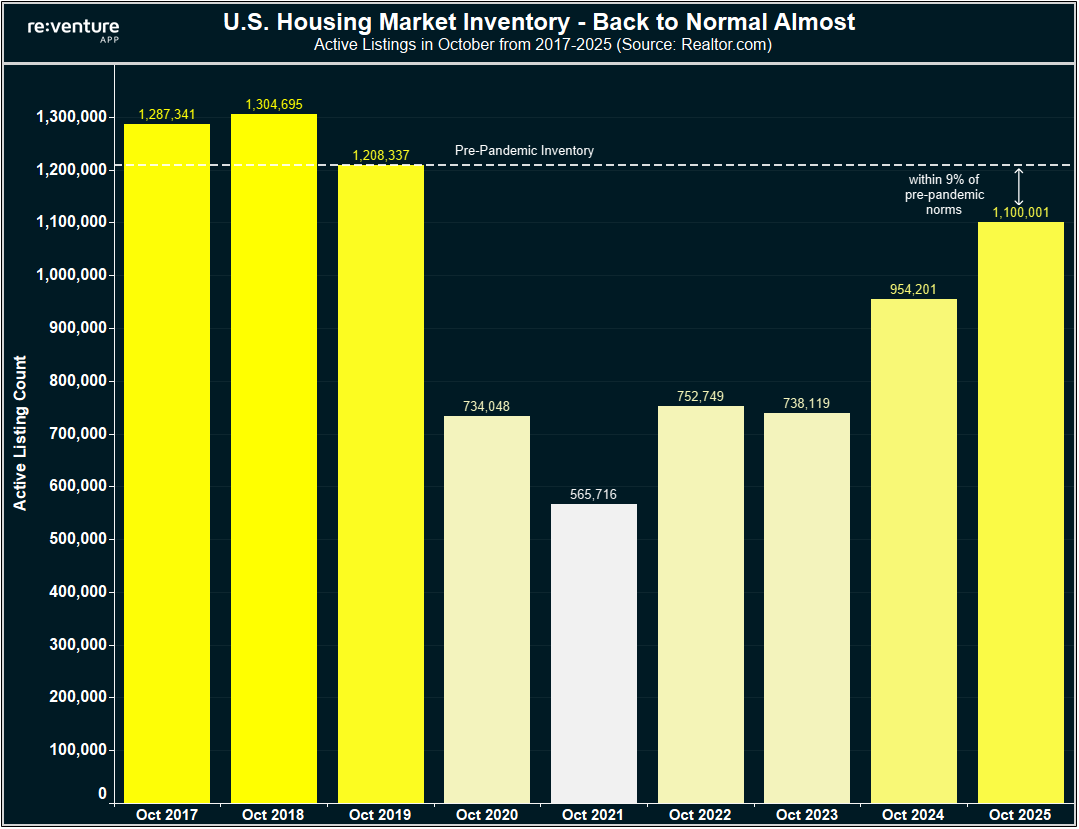

As more owners decide to move despite higher rates, the market will likely experience a steady increase in new listings. Early signs of this shift are already visible. Several national data sources show rising active inventory in 2024–2025, and leading indicators — such as price cuts, longer days on market, and an uptick in seller concessions — all suggest the market is loosening beneath the surface.

According to Realtor.com, there are now 1.1 million active listings on the U.S. Housing Market, which is the highest level for the month since 2019. Moreover, this level is now within 9% of the pre-pandemic inventory range on a national basis, indicating that the U.S. “housing shortage” is almost over (and in some Sun Belt and West Coast markets it’s been over for over a year already).

At Reventure, we’re closely analyzing what will happen to for-sale inventory in 2026 as the mortgage rate lock-in effect continues to fade. Our view is that upward pressure on new listings will intensify into the Spring. Many homeowners who have resisted selling over the past two years will finally enter the market, pushed by life events, financial factors, and a diminishing payment advantage from their old low-rate mortgages. If current trends continue, inventory could spike further — and by mid-2026, the U.S. may be facing the highest level of resale inventory in more than a decade.

Will Home Prices drop if we see higher Inventory? Look at rents.

Such an outcome would place significant downward pressure on home prices. Markets that have already turned negative could decline further, while regions that have held steady — particularly across the Midwest — may finally slip into negative territory as supply outpaces demand.

There is, however, one variable that could soften or delay this correction: rents. If the rental market tightens and rents begin rising again, the dynamic shifts. Higher rents could pull more first-time buyers into the market, providing a marginal boost to demand. At the same time, stronger rental income prospects could dissuade would-be sellers from listing their homes and instead encourage them to convert properties into rentals. In that scenario, the inventory spike we anticipate for 2026 would be more muted — and price declines less severe — than our base case currently suggests.

The Role of Rents: A Critical Valuation Anchor

But right now, rents are not growing by much and are even dropping significantly in some markets. According to data from CoStar, October 2025 apartment rents had their biggest decline for the month going back 15 years. Meanwhile, Invitation Homes, the largest publicly traded single-family landlord in the U.S., reported declining new lease rent growth in Q3 2025.

And we can see certain markets are getting hit particularly hard by rent declines. Data from Apartmentlist shows that areas like Austin, Fort Myers, Atlanta, and Denver have experienced double-digit rent drops since 2022, with further rent drops anticipated in 2026 due to increasing vacancy rates.

When rents decline while home prices remain elevated, valuation ratios compress. Price-to-rent ratios expand to levels that historically precede corrections. Several markets across the Sun Belt and Mountain West are already exhibiting these patterns: elevated inventory, declining rents, rising vacancies, and growing price cuts.

Access Home Value to Rent data on Reventure App for your City and ZIP

If these rent trends persist into 2026, the impact of rising for-sale inventory will be amplified. Investors become less active in falling-rent environments. Homebuyers compare monthly ownership costs to softening rents and step back. Sellers must reduce prices to attract shrinking pools of qualified buyers.

Markets with declining rents are therefore the most exposed to price downside in 2026. Rising supply + weakening rental fundamentals is a powerful combination, and both conditions appear increasingly likely next year.

The Macro Setup: Still Not Supportive of Price Growth

Even if mortgage rates decline modestly in 2026, it is unlikely that rates will fall back to levels that restore 2021-style affordability.

A moderate decline in mortgage rates might stimulate some demand, but not enough to offset the supply pressures forming from a fading lock-in effect and declining rental market. Sellers returning to the market create listing growth that demand cannot fully absorb unless rates fall dramatically — a scenario that appears unlikely given current inflation dynamics and fiscal conditions.

Reventure’s Outlook: Downward Pressure in 2026

Taking all these factors together — fading lock-in, rising inventory, softening rents, and persistent affordability problems — Reventure expects continued downward price pressure in 2026, especially in markets with the following characteristics:

-

Declining or stagnant rents

-

High investor concentration

-

Large buildups of new multifamily supply

-

Rapid pandemic-era price appreciation

-

Elevated price-to-income and price-to-rent ratios

Some markets may hold steady, particularly those with strong job growth or chronic supply shortages. But for much of the country, 2026 represents the first plausible year since the pandemic when housing fundamentals could meaningfully overpower the distortions that kept prices elevated from 2020–2024.

Conclusion

The U.S. housing market of 2026 will not resemble the market of the past three years. The Mortgage Rate Lock-In Effect that dominated the pandemic era is fading. Inventory is rising. Rents are softening. Affordability remains stretched. This combination is historically associated with slower home-price growth — and often, outright declines.

Whether home prices fall next year — and by how much — will vary by region, but the national setup is increasingly pointing toward softening conditions rather than renewed price acceleration. For buyers, that means more opportunities. For sellers, it means adjusting expectations. For investors, it means being selective and understanding that the easy appreciation years are behind us.

Reventure will continue monitoring these trends as the data evolves — but as of today, the weight of evidence suggests that 2026 may finally be the year when U.S. housing prices reset toward fundamentals. Access the data for your market today on Reventure App.

3 Responses