Denver Housing Market is Potentially Entering a Correction in 2025

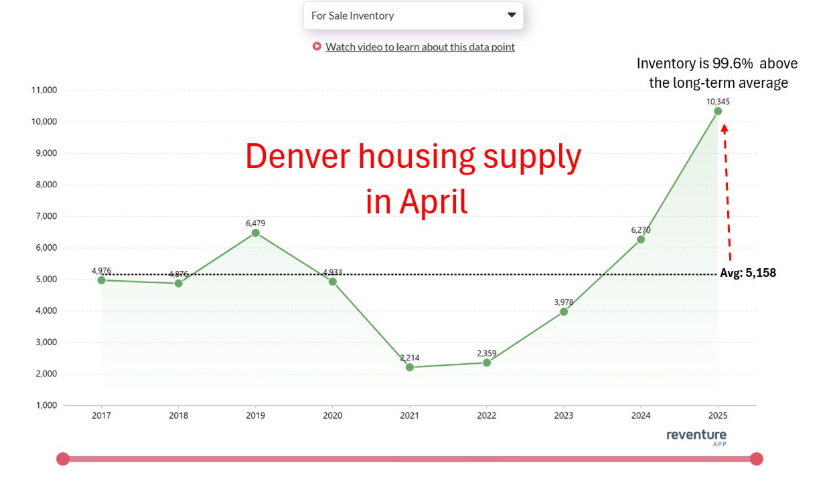

“Denver’s housing market could be on the verge of a correction in 2025, with listings skyrocketing and active inventory now sitting at the highest level in a decade”, according to Nick Gerli, CEO of Reventure App. Inventory levels have nearly doubled the long-term April average, surging by 99.6% compared to previous norms.

In April alone, active listings climbed to 10,345, far surpassing the historical average of 5,158. This sudden spike indicates a potential correction brewing beneath the surface. Moreover, as supply continues to rise at an aggressive pace, property values in the Denver metro are beginning to decline monthly.

Denver housing inventory in April 2025 nearly doubled the average, highlighting a potential market correction. Access the above graph here. [Link]

If current trends persist, prices could continue to slide throughout the remainder of the year. Reventure is now forecasting a 9.1% drop in Denver home values over the next 12 months. “Homebuyers will welcome this price relief, but values will still feel expensive compared to pre-pandemic norms,”

However, whether this shift is a short-lived shock or the start of a broader downturn remains uncertain. The coming months will be critical in revealing whether Denver’s market is simply cooling or fundamentally correcting.

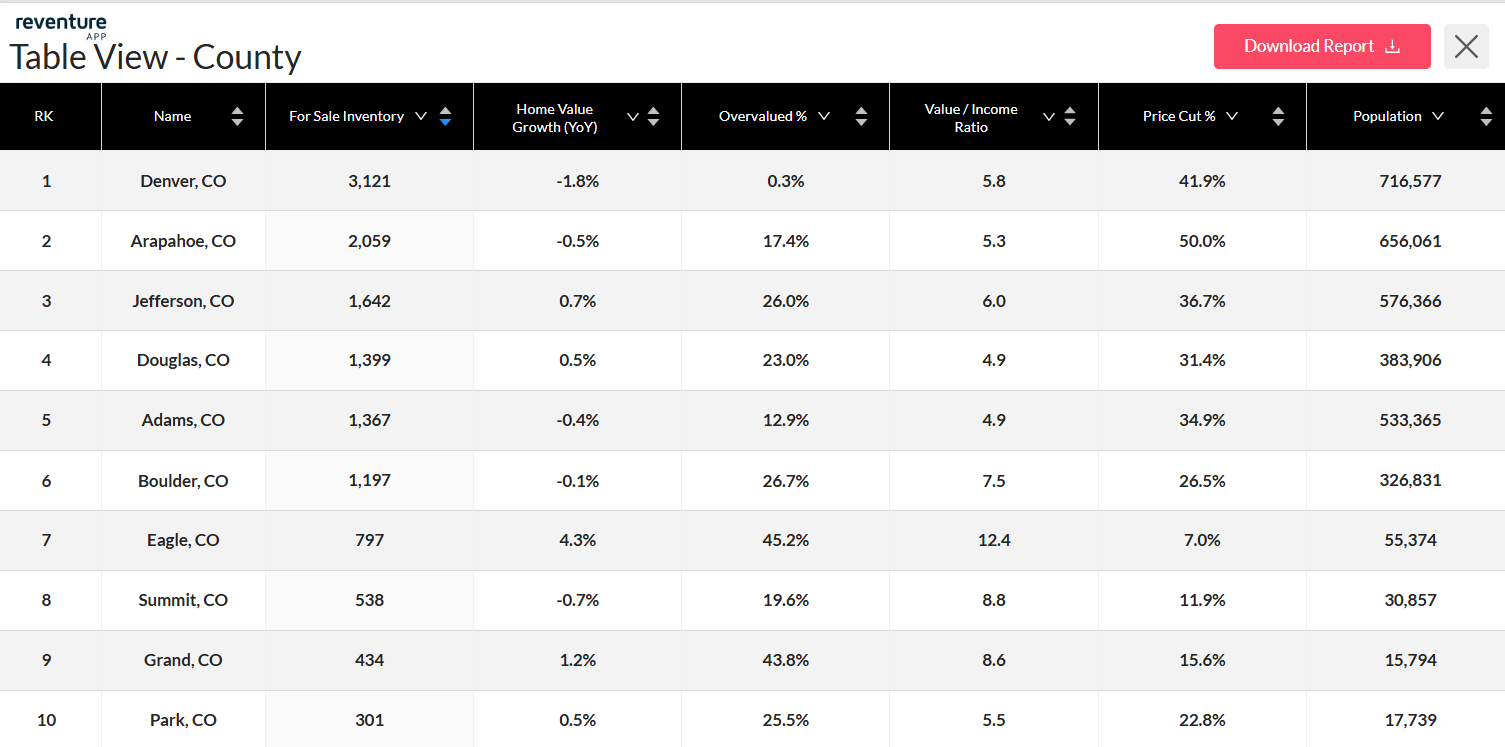

Denver Metro’s Top 10 Counties Show Signs of Market Cooling in 2025

As Denver’s housing market experiences a broader shift, a closer look at county-level data reveals that signs of correction can be seen throughout the metro. Here is the detail:

Denver County

Denver County itself is at the forefront of the correction. Active listings have reached 3,121, and home values are already down -1.8% year-over-year. Moreover, 41.9% of listings are seeing price cuts, which is the highest level among major counties. Despite only a slight overvaluation of 0.3%, the rapid inventory surge and falling demand are placing direct downward pressure on prices.

Arapahoe County

Arapahoe County’s inventory stands at 2,059, with a -0.5% decline in home value growth. What’s more notable is that 50% of listings have seen price reductions, which is the highest percentage among the ten. Despite a 17.4% overvaluation, the steep price cuts indicate that sellers are adjusting quickly to cooling demand.

Jefferson County

Jefferson County is moderately overvalued at 26%, with home values still growing at 0.7%. However, 36.7% of listings have undergone price cuts, indicating a mismatch between seller expectations and buyer affordability. With 1,642 homes on the market, softening is likely to continue.

The above table presents the counties in Denver with the highest sales inventory in 2025. Access the above table here. [Link]

Douglas County

Douglas County, with 1,399 listings, shows an overvaluation of 23%. While home values are still inching up (0.5%), the 31.4% price cut rate reflects mounting pressure in this higher-income market.

Adams County

Adams County, home to over 533,000 residents, has a relatively modest inventory of 1,367 homes. Yet price cuts are at 34.9%, and home values are down -0.4% YoY, suggesting affordability issues are dampening demand.

Boulder County

Though Boulder is the most overvalued major county (26.7%) with the highest value-to-income ratio (7.5), price cuts remain moderate at 26.5%. Home value growth is slightly negative (-0.1%), but the area’s unique demographics may delay steeper declines.

Counties Facing Unique Corrections

Counties like Eagle, Summit, Grand, and Park are seeing slower home value growth or declines, despite lower inventory. Eagle and Grand counties, for instance, have overvaluation rates above 40%, suggesting these markets may be more vulnerable if the broader correction accelerates.

Forecast Indicates Buyer’s Market Ahead for Denver 2025 – 2026

Based on Reventure’s Home Price Forecast score, Denver’s housing market is firmly entering a declining phase in 2025–2026. The forecast has dropped to 26 out of 100, well below the stability threshold, indicating reduced buyer demand, a growing number of sellers, longer days on market, and an increase in price cuts. This sharp fall from 40 in 2024–2025 suggests that market momentum is rapidly shifting away from sellers.

As this trend persists, future home price declines are highly probable. The transition from a seller’s market to a clear buyer’s market underscores a broader correction underway, with affordability, inventory, and buyer hesitation shaping the year ahead. If you need ZIP code-level information on Denver’s housing situation, sign up for Reventure Apps’ premium plan for just $39/ month. Get exclusive access to various market metrics across any state, metro, county, or ZIP code in the U.S.

FAQs about Denver Housing Market

1. Why is Denver’s Housing Market Considered to be Entering a Correction in 2025?

Denver’s housing inventory surged by 99.6% in April 2025, nearly doubling the long-term average. Combined with rising price cuts and a forecasted 9.1% price drop, these trends indicate declining buyer demand and increased seller pressure, key signs of a market correction.

2. What Does a Reventure Home Price Forecast Score of 26 Mean?

A score of 26 out of 100 suggests a declining housing market. It implies reduced buyer activity, longer selling times, and more price reductions. If conditions persist, Denver may continue transitioning further into a buyer’s market throughout 2025–2026.