Are Las Vegas Home Prices on the Verge of Crashing in 2025?

Las Vegas is one of the most volatile housing markets in the U.S., with home prices crashing over 60% during the last downturn. From February 2020 to February 2025, typical home values surged by 47.8%, rising from $291,216 to $430,450. Moreover, with annual growth slowing noticeably since 2022, many are beginning to question whether home prices are about to crash in 2025. Let’s explore that in detail:

Las Vegas Market Softening As Affordability Remains a Challenge in 2025

The Las Vegas housing market is beginning to show signs of softening. In March 2025, price cuts were reported on 28.6% of listings, up from just 18.3% in 2024, indicating that more sellers are adjusting expectations. Meanwhile, sale inventory is also on the rise, jumping 67.8% year over year, following a sharp 33% drop in 2024. This sudden influx of homes for sale suggests that homes are taking longer to sell, softening the previously hot market.

28.6% of sellers in Las Vegas are cutting prices compared to long-term norms in 2025. Access the above price cut % graph here. [Link]

Despite this, home values are still rising. According to the data available on Reventure App, Las Vegas reached a year-over-year home value growth of 4.9%, driven in large part by the tight inventory seen throughout 2023 and early 2024. That low supply environment kept prices elevated, leaving many buyers feeling squeezed. So as the market appears to be shifting toward decline, the lingering effects of recent supply constraints mean affordability remains a real concern for prospective homeowners trying to enter the Vegas market in 2025.

Affordability Pressures Persist, but Market Cooling Suggests Possible Relief in 2025

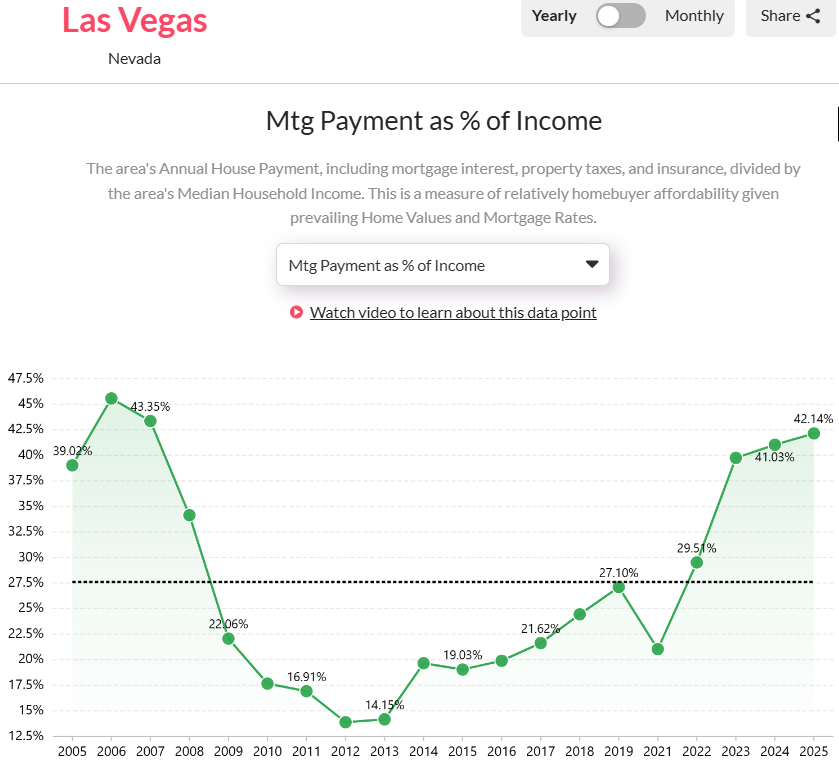

In 2025, the typical Las Vegas homebuyer needs to spend 42.14% of their income on mortgage payments, one of the highest levels recorded in the past two decades. This marks a sharp rise from just 29.5% in 2022, indicating a steep decline in affordability. However, relief may be on the way. For-sale inventory in Las Vegas has jumped from 4,720 in 2024 to 7,922 in 2025, easing some pressure on buyers. Moreover, 28.6% of listings experienced price cuts in March 2025, suggesting sellers are becoming more flexible.

Vegas homebuyer needs to spend 42.14% of their income on mortgage payments in 2025. Access the above graph here. [Link]

These trends are beginning to slow home price growth. Year-over-year value increases have already dropped from 25.0% in 2022 to 2.4% in 2023 and now 4.9% in 2024. If inventory continues to climb and demand remains tepid, it is possible the home value growth could slip into negative territory by late 2025. However, given current fundamentals, a full-blown market crash still appears unlikely. If you want a detailed analysis of the Las Vegas, NV metro area, explore the housing market data at the ZIP-code level on Reventure App.

FAQs about Las Vegas Home Prices

1. Will Las Vegas Home Prices Drop in 2025?

Home prices in Las Vegas are showing signs of slowing growth, with year-over-year gains falling from 7.4% in 2022 to 4.9% in 2024. While there is a possibility that price growth could turn negative later in 2025, a significant crash does not seem imminent based on current data.

2. Is Now a Good Time to Buy a House in Las Vegas?

That depends on your financial situation. With inventory increasing and 28.6% of listings seeing price cuts, buyers may find more options and negotiating room in 2025. However, affordability remains a challenge as mortgage payments now consume 42.14% of income.

3. Why Are Las Vegas Home Prices Still High Despite More Inventory?

Prices remain elevated largely due to historically low inventory levels in 2023 and early 2024. The market is now adjusting, but it may take time before increased inventory significantly impacts affordability.