Airbnb’s slowdown Is Spreading to the Housing Market: Here’s Who’s Getting Hit First

Airbnb’s empire is showing cracks. And the housing market is starting to feel it. Moreover, the short-term rental giant pulled in $11.1 billion in 2024. It was up 12% but net income slid to $2.6 billion, hinting at tighter margins and rising costs.

However, Airbnb still dominates travel housing with 8 million listings and 5 million hosts worldwide. Yet across U.S. markets, supply growth has plunged from 20% two years ago to its lowest level this year. Demand has softened, too, even as nightly rates inch higher.

Investors are backing off. Homes once used for quick profits are returning to the long-term market. All of it is reshaping housing supply. Let’s find out more about it:

1. The Supply Reversal

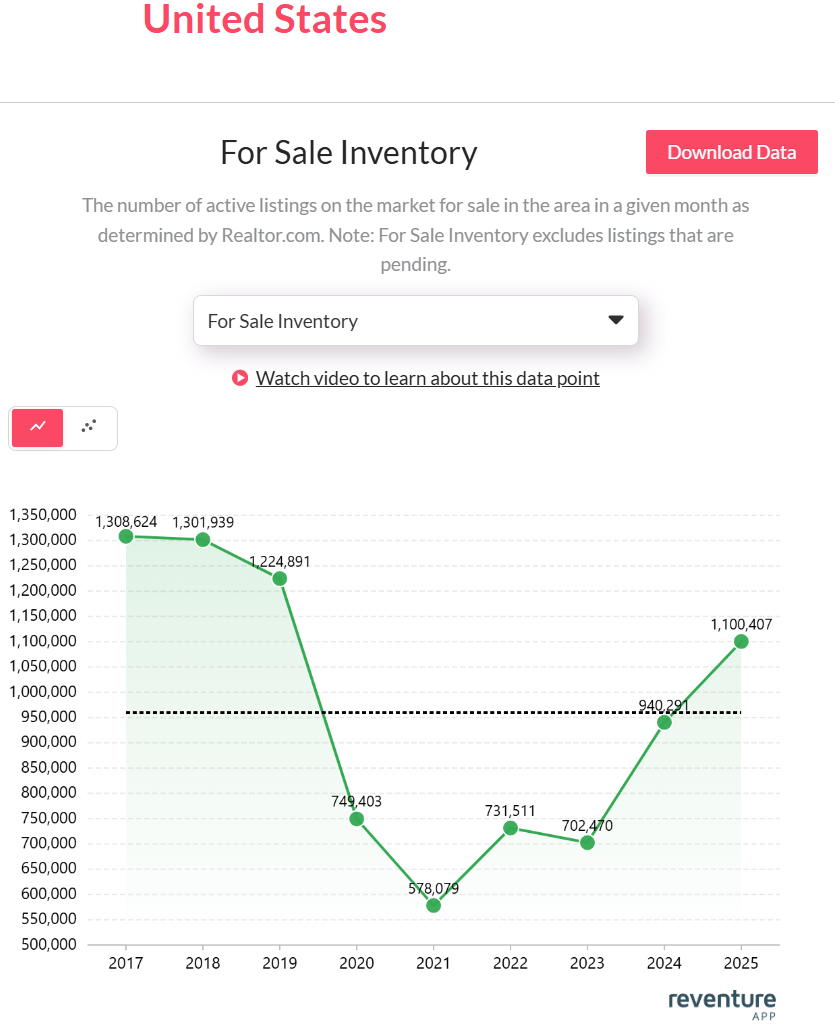

Airbnb’s slowdown is starting to show up in housing data. According to Realtor.com data available on Reventure App, active listings have climbed to 1.1 million in 2025. The number is up from 940,000 last year, which is a sharp 17% increase.

Active listings have climbed to 1.1 million in 2025. Access the above graph here. [Link]

It’s the biggest jump in supply since 2020 and a clear sign that investors are backing away. Many short-term rental owners who once thrived on record bookings are now listing their properties for sale as occupancy drops and maintenance costs rise.

This shift marks a major turning point. During the pandemic, inventory collapsed to just 578,000 homes, fueling bidding wars and price spikes. Now, the tide is moving the other way. Homes once used for Airbnbs are quietly re-entering the long-term market. And that’s helping in lifting the national inventory for the first time in years.

It’s the clearest evidence yet that the Airbnb unwind is spilling into America’s housing supply.

2. Rent Cooldown and Affordability Shift

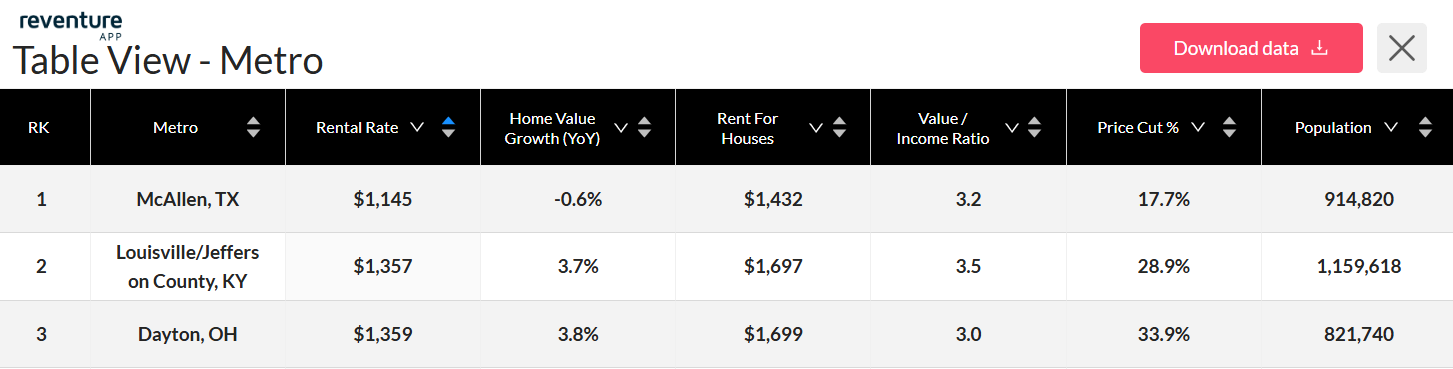

The shift in Airbnb’s fortunes can be seen through rental markets across the country. And nowhere is it clearer than in America’s most affordable metros. According to Realtor.com data available on Reventure App, McAllen, TX, Louisville, KY, and Dayton, OH now post the lowest median rental rates nationwide, ranging from $1,145 to $1,359 per month.

McAllen, TX, Louisville, KY, and Dayton, OH now post the lowest median rental rates nationwide. Access the above table here. [Link]

These cities avoided the worst of the short-term rental boom. And now they’re seeing a stabilizing effect as properties re-enter the long-term market. In McAllen, where the typical home value slipped 0.6% year-over-year, rising availability has kept rents modest even as other metros struggled with affordability.

Louisville and Dayton, meanwhile, show rent for houses around $1,700. And they show healthy home value growth near 3.7–3.8%, suggesting balanced demand without overheating. It’s an indication that sellers are testing the waters instead of capitulating.

Think of it as a slow thaw rather than a full-blown freeze-out. Unless inventory breaks higher or mortgage rates fall meaningfully, we’re likely to stay in this soft-adjustment zone for months to come. Price cuts are rising, too.

Price cut % has reached 33.9% in Dayton and nearly 29% in Louisville. These are the indications that sellers are adjusting expectations amid cooling demand. As Airbnb hosts offload underperforming rentals or convert them to leases, long-term tenants are finally catching a break.

3. Who’s Getting Hit First

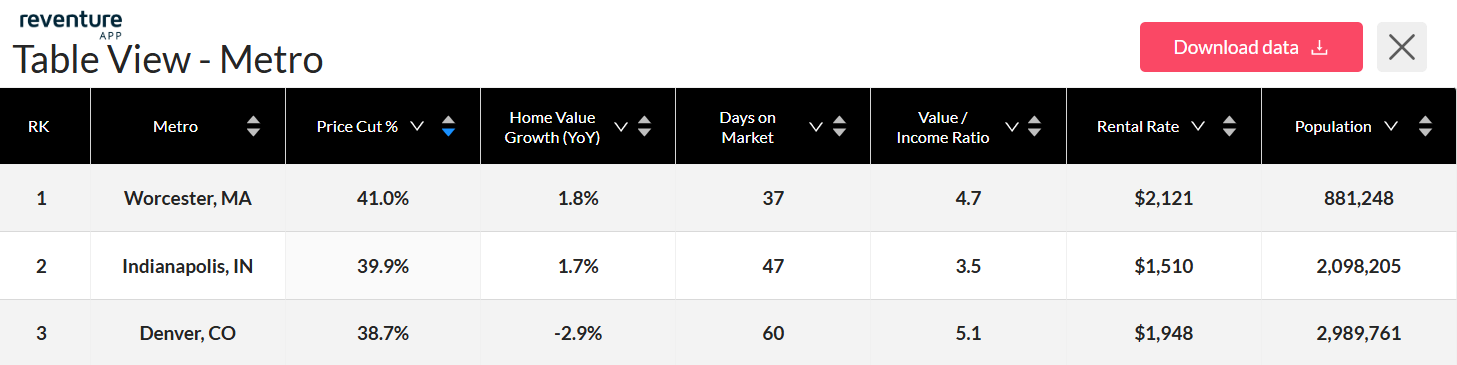

The first cracks from Airbnb’s slowdown are showing in the nation’s mid-sized metros. According to Realtor.com data available on Reventure App, Worcester, MA, Indianapolis, IN, and Denver, CO are seeing some of the steepest price cuts in the country. These are 41%, 39.9%, and 38.7%, respectively.

Worcester, MA, Indianapolis, IN, and Denver, CO are seeing some of the steepest price cuts in the country. Access the above table here. [Link]

These markets tell the story of investors and hosts running out of room to wait. In Worcester and Indianapolis, home values are still inching up 1.7–1.8% year-over-year. And the price cuts reflect sellers’ urgency to move listings that are sitting 37–47 days on the market. Many of these properties were once profitable as short-term rentals but now face lower occupancy and thinner margins.

Denver shows a deeper strain. Home values there are already down 2.9%, and its high value-to-income ratio of 5.1 indicates affordability stress. With average rents near $1,948, the math for holding multiple units no longer works for smaller hosts.

As short-term rental returns weaken, these investor-heavy cities are becoming the first to reset. Homes once booked by tourists are reappearing on Realtor.com feeds. Not as listings for a weekend stay, but as price-reduced properties searching for a buyer.

Final Thoughts

Airbnb’s boom years reshaped housing markets across America. Now, its slowdown is sending those same markets into a reset. Inventory is rising, and rents are cooling. And mid-sized metros are feeling the first cracks. Investors who chased short-term returns are stepping back, and long-term renters are finally finding relief. The correction has begun, and the next phase of housing affordability may be unfolding right now.

If you want to see your state, metro, or county’s Airbnb situation, buy Reventure Premium. For just $49 a month, you can access 40+ data points, from mortgage-to-income ratios to home values and inventory growth. And it offers 6x more accurate forecasts than Zillow. Because in a market that’s holding tighter than ever, precision isn’t a luxury.

Upgrade to Reventure Premium