What the Latest Zillow Data Reveal About Mortgage Rates & Buyer Momentum in the U.S

Mortgage rates are finally showing signs of easing, and it’s starting to shake up the U.S. housing market. Zillow’s latest data reveals a subtle but meaningful shift, rates are drifting lower, and buyers are beginning to re-enter the market.

After years of high borrowing costs, this small relief is reigniting buyer momentum across key metros. Homes are staying on the market longer, giving buyers more room to negotiate. Yet affordability remains a challenge, and experts warn that rates will likely hover between six and seven percent through 2026. Still, this dip could mark the market’s long-awaited turning point.

Let’s get into its details:

Mortgage Rates and Monthly Payments

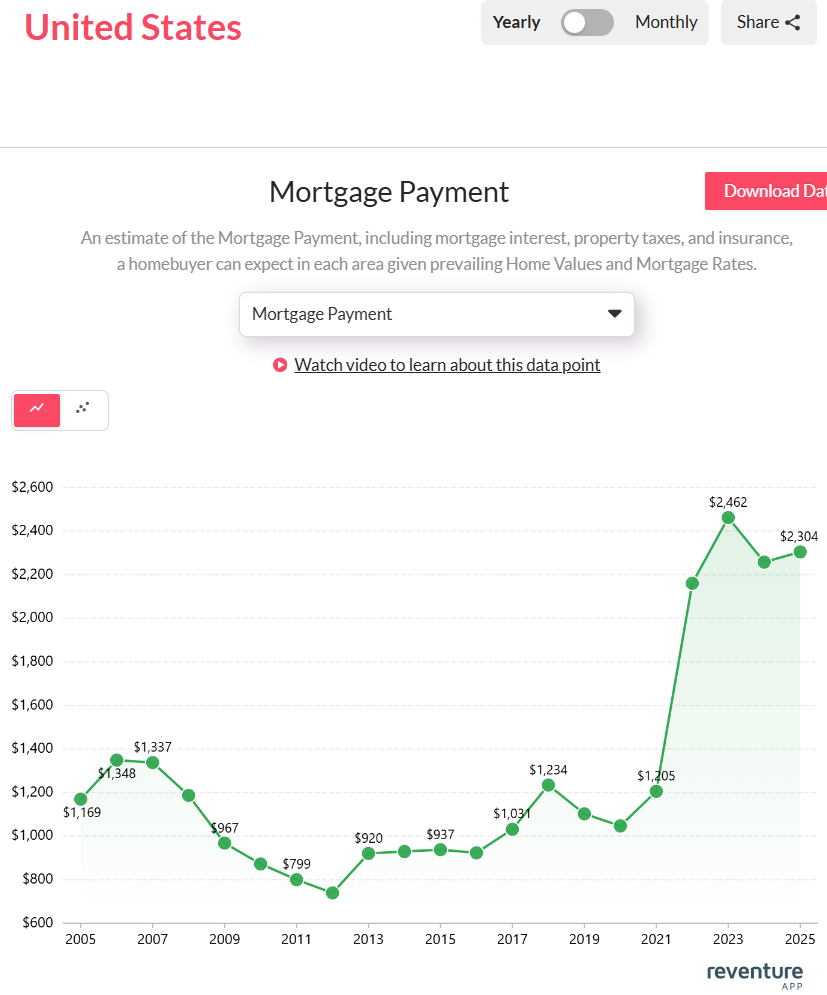

Mortgage rates may finally be easing. But the cost of owning a home is still far higher than it used to be. Zillow’s latest data and Reventure’s figures show the average U.S. mortgage payment peaked at $2,462 in 2023, the highest on record. Even after a small drop to $2,304 in 2025, payments remain almost 3x higher than in 2012, when buyers paid around $799 per month.

This rise tells that both home prices and borrowing costs exploded after the pandemic. The average 30-year fixed mortgage rate climbed above 7 %. And it pushed monthly payments to levels unseen in decades. For many buyers, affordability became the biggest hurdle.

U.S. mortgage payments peaked at $2,462 in 2023, nearly triple 2012 levels, before easing slightly to $2,304 in 2025. Access the above graph here. [Link]

From 2005 to 2020, payments mostly stayed between $900 and $1,300. But since 2022, costs have surged nearly $1,000 per month compared to those of buyers just five years ago. That gap has changed how Americans think about buying homes.

Reventure data shows the share of mortgaged homes dropped from 67.8 % in 2009 to 59.7 % in 2024, the lowest in modern history. More owners now hold properties outright, while others delay buying altogether. Many renters are simply waiting for rates to fall enough to make ownership possible again.

Zillow expects mortgage rates to hover between 6 % and 7 % through 2026, meaning relief will come slowly. Yet the slight drop in payments and rising inventory suggest the market is stabilizing. Buyers are regaining confidence after two years of stagnation.

Price Cuts and Buyer Power

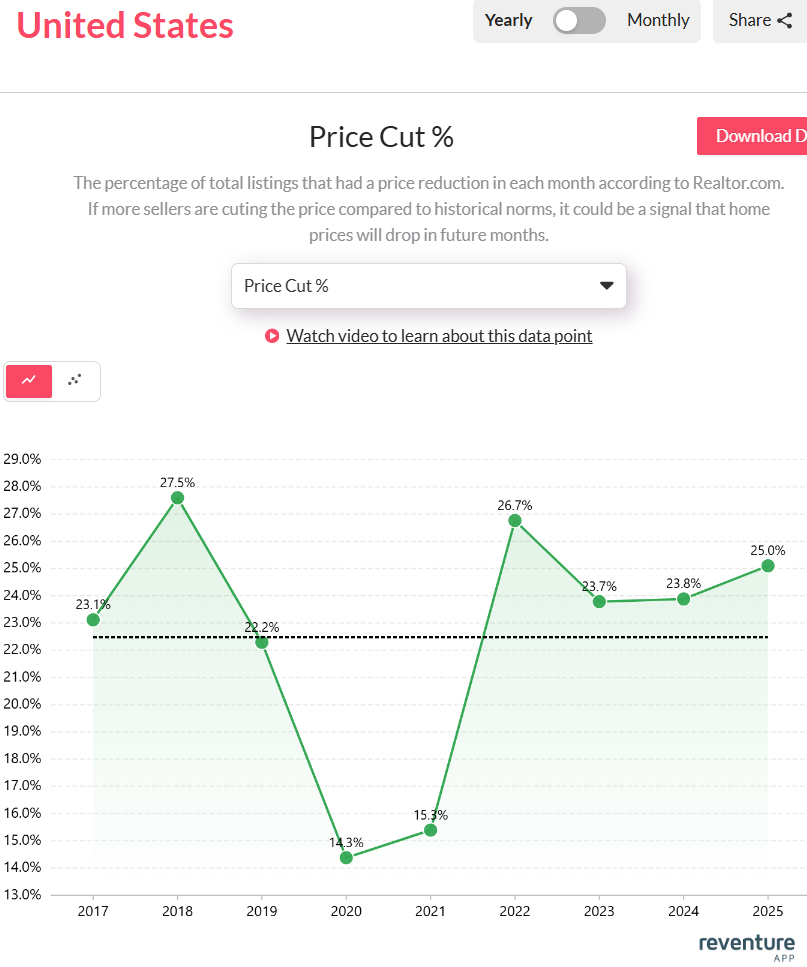

After years of sellers calling the shots, the tide is turning. The Price Cut % data by Realtor.com shows that in 2025, about 25 % of all home listings included a price reduction. That’s up slightly from 23.8 % in 2024 and well above the pandemic-era low of 14.3 % in 2020. It’s a clear indication that sellers are finally adjusting to buyers’ tighter budgets.

In 2018, nearly 27.5 % of listings had price cuts, reflecting a cooler pre-COVID market. Then, during the frenzy of 2020–2021, discounts nearly vanished as cheap credit and panic buying drove bidding wars. But by 2022, cuts spiked again to 26.7 %, showing how quickly the balance shifted once rates jumped.

About 25% of U.S. listings saw price cuts in 2025, up from pandemic lows. Access the above graph here. [Link]

Now, in 2025, we’re back in the middle zone, not a crash, but a correction. Sellers are learning that pricing aggressively doesn’t work when monthly payments are $2,000 plus. Zillow’s analysis aligns with this, noting that homes are sitting longer on the market and buyers have more room to negotiate. For many, a modest rate dip isn’t enough. They need price adjustments to make deals feasible.

What makes this trend human is the psychology behind it. Buyers have grown cautious. They’re no longer rushing to outbid everyone else. They’re calculating. They’re waiting for that small cut that brings a home back within reach. And sellers, feeling the slowdown, are responding one listing at a time.

If this continues, 2025 could become the year of measured normalization. Lower rates create curiosity, and price cuts create opportunity. Together, they might finally thaw a market frozen by fear and affordability gaps.

Final Thoughts

The U.S. housing market is slowly finding its balance. Mortgage rates are easing, and sellers are beginning to adapt. While affordability challenges remain, confidence is returning on both sides. If current trends hold, 2025 may be remembered as the year when patience, realism, and renewed buyer momentum reshaped America’s housing story.

If you want to see your state, metro, or county’s housing situation, buy Reventure Premium. For just $49 a month, you can access 40+ data points, from mortgage-to-income ratios to home values and inventory growth. And it offers 6x more accurate forecasts than Zillow. Because in a market that’s holding tighter than ever, precision isn’t a luxury.

Upgrade to Reventure Premium