Why Texas’s Housing Correction Will Get Worse in 2025? “Listings Keep Skyrocketing”

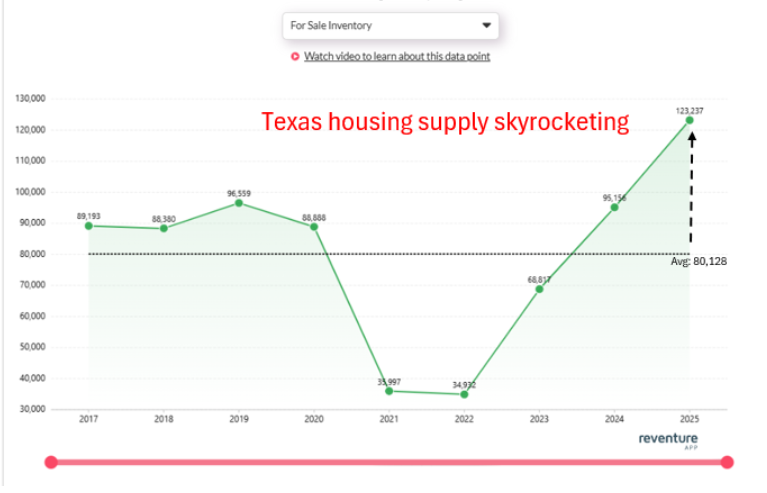

Texas is leading the U.S. in housing supply growth, and that’s not good news for home prices. According to new data from Realtor.com analyzed by Reventure App, the number of homes for sale in Texas soared to 123,237 in April 2025, marking a record high and a 53% increase above the historical average of 80,128. That’s the highest level of inventory in over a decade, and it’s fueling a statewide housing correction that’s only expected to deepen.

Texas housing inventory hits 123,237 in April 2025, which is 53% above normal. Access the above graph here. [Link]

“We need to talk about Texas,” said Nick Gerli, CEO of Reventure. “Listings just hit 123,000 in April 2025. 53% higher than normal. And prices are now dropping across the state.” His warning reflects a growing divide between swelling supply and slowing demand.

The surge in listings, up from just 68,851 last year, indicates a sharp shift in market dynamics. With affordability stretched and more homes lingering on the market, price declines are beginning to ripple through major Texas metros.

Price Cuts Spike in Texas as Sellers Struggle to Keep Up with Market Reality in 2025

Texas homeowners are slashing prices at a rate not seen in years. In April 2025, 27.7% of all listings across the state had a price reduction, the highest percentage since Reventure began tracking the data. That marks a dramatic reversal from just a few years ago, when the pandemic-era buying frenzy pushed price cuts to a historic low of 8.1% in 2021.

Texas metros like Midland, Dallas, and Austin lead the state in price cuts, with over 30% of listings slashing asking prices as home values slip. Access the above table here. [Link]

This statewide trend is even more severe in major metros. Midland leads Texas with a staggering 39.4% of listings marked down, followed by Dallas (34.3%) and Austin (33.6%), where home values are now declining year-over-year by -1.3% and -3.8%, respectively. Even larger cities like San Antonio (31.6%) and Waco (31%) are seeing nearly a third of their listings undergo price cuts, reflecting weakening buyer demand.

“These price reductions are the canary in the coal mine,” said Nick Gerli, CEO of Reventure. “They predict future price declines and growing desperation among sellers to attract scarce buyers.”

With affordability stretched thin and competition dwindling, sellers in many Texas metros are finding they no longer hold the upper hand.

Homes Are Sitting Longer as Buyer Urgency Fades in 2025

The slowdown in Texas housing isn’t just visible in rising inventory and price cuts, it’s also showing up in how long homes are sitting on the market. In April 2025, the median number of days on market climbed to 50, up from 48 in 2024 and nearly 20 days higher than the pandemic low of 31 days in 2022.

This upward trend indicates a clear shift in market sentiment. During the pandemic boom, listings moved fast as buyers scrambled for limited options. Now, with listings surging and affordability strained, homes are lingering. Sellers no longer benefit from bidding wars or rushed buyers, particularly outside the most desirable neighborhoods.

Texas homes now spend a median of 50 days on the market. Access the above graph here. [Link]

The current days-on-market metric is also approaching pre-pandemic norms, such as the 52-day average seen in 2017 and 2019, reflecting a market returning to a more balanced, yet increasingly slow state. Moreover, this increased time on market further pressures sellers to drop prices or offer incentives to attract interest.

And as more homes remain unsold for longer stretches, inventory continues to stack up, amplifying the correction already underway in Texas. Unless buyer demand meaningfully rebounds, this trend is likely to persist into the second half of 2025, reinforcing broader concerns about sustained weakness in the state’s housing market.

If you need ZIP code-level information on Texas’s housing market correction, sign up for Reventure Apps’ premium plan for just $39/ month. Get exclusive access to various market metrics across any state, metro, county, or ZIP code in the U.S.

FAQs about Texas Housing Market Correction

1. Why are home prices falling in Texas in 2025?

Home prices are falling in Texas due to a sharp increase in housing inventory, 123,237 listings in April 2025, 53% above normal, combined with weakening buyer demand and affordability constraints. Sellers are cutting prices aggressively to attract interest.

2. Which Texas Cities are Seeing the Biggest Housing Corrections?

Major metros like Midland, Dallas, and Austin are leading the correction. Over 30% of listings in each city had price cuts in April 2025, with Austin seeing home values drop by -3.8% year-over-year. Days on market are rising across most regions, indicating further weakness ahead.

Access Housing Market data for Texas and All Other U.S. States on Reventure App.